It's quick and easy to combine your super

15 May 2024

5

min read

Having your super in different super funds may be costing you money. It’s easy to combine all your super into one account – just follow these simple steps.

If you've ever changed jobs, moved house, or even changed your name, you might have more than one super fund. And that means paying more than one set of fees.

What consolidating your super means

Consolidating1, or combining your super, means moving all of your super into one account.

You can even find any lost super and add it to your account. The Australian Tax Office (ATO) is holding $16 billion in lost super as of 30 June 2023.2 Some of it might be yours.

It’s quick and easy to do and makes your super easier to manage and saves on fees.

Why consolidate super?

By consolidating your super, you may save money and make it easier to keep on top of your retirement savings.

Taking simple steps to awaken your super now, which for many people is among their largest financial assets, means you may have more money for your retirement lifestyle.

Benefits of consolidating your super into one account can include:

- Paying fewer fees – having your super in one account could mean fewer fees

- Reducing paperwork – one super account means one statement

- Keeping track of your super – one super account may make your super easier to manage

- Avoiding excess insurance premiums – one super account reduces your chance of paying multiple insurance premiums.

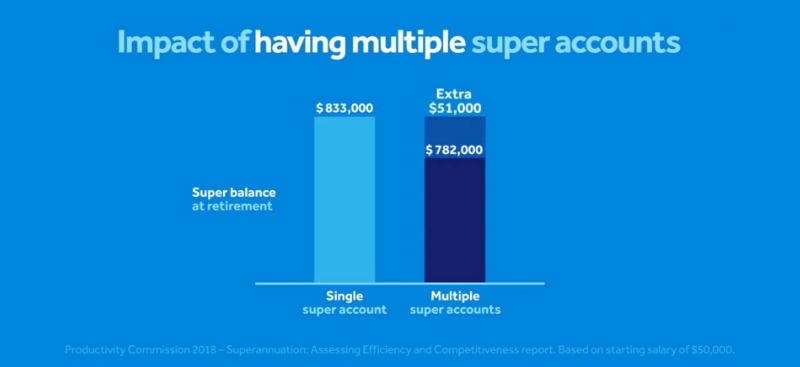

Having multiple super accounts could cost you money

Having multiple super accounts instead of one super account can be costing you money which reduces how much money you have to spend in retirement.

Modelling by the Productivity Commission3 found having multiple accounts can cost as much as one year’s lost pay.

Based on a $50,000 full-time starting salary, having one super account or multiple accounts means the difference between having $833,000 for your retirement or $782,000. That’s $51,000 or 6% less to spend in retirement due to multiple accounts.

Is now a good time to consolidate your super?

You can consolidate your super any time.

Before you do, here’s some things to consider:

- Consolidating your super into one fund may mean that some of your money being transferred may be out of the market for a short period of time. In times of volatility, the time that your money is out of the market may have an impact on your balance.

- Check with your other funds to see if you may lose any benefits like insurance or pension options.

- If you want to consolidate with us and you have insurance with another fund, you may be able to transfer your cover across. You may need to make sure your transfer of insurance cover is complete before you consolidate your super.

- Delaying consolidation may mean continuing to pay higher fees in total if you have a number of superannuation funds.

Quickly and easily find any lost super

The ATO held $16 billion as lost or unclaimed superannuation in more than 7 million accounts across Australia as of 30 June 2023.

It’s easy to find your lost super.

Through Member Online, you can search for a full list of any super accounts you may have with other super funds, and any ATO-held super that may belong to you. There are no paper forms to sign or mail in.

If we find other super for you, you'll be given a choice to consolidate it into your QSuper account.

1. Please consider if the timing is right to bring your super together, and if you will lose access to benefits such as insurance or pension options, or if there are any fee or tax implications.

2. Australian Taxation Office, 26 February 2024, Total lost (fund-held) and ATO-held super, at ato.gov.au

3. Productivity Commission Inquiry Report, 21 December 2018, Superannuation: Assessing Efficiency and Competitiveness at pc.gov.au