Grow your super faster with compound interest

01 July 2024

5

min read

Putting any extra money into your super now can make a big difference to how much money you end up with by the time you retire. Here are simple ways to help grow your super.

The more money you save in your super during your working life means the more you may have for your lifestyle when you retire. Putting just a little extra into your super now can make a big difference later, and may even help you save some money on tax.

You can grow your savings faster with the power of compound interest. The longer you save, the more interest you could earn. Keep in mind that you won’t be able to access money you contribute to super until your reach retirement, or if you become eligible to access to your super early.

How compounding can help grow your super

Compound interest is one of the most powerful forces in finance. Compounding is the process of earning interest on interest.

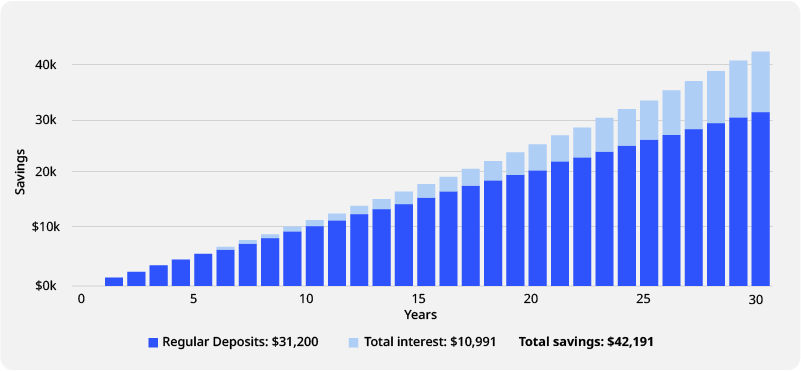

For example, if you contribute $20 per week into your super for 30 years, you could have over $40,000.1 Over $10,000 of that total comes from the interest you earn from compound interest, assuming a real return of 2%.

1. The figures are illustrative only and we worked them out using the ASIC MoneySmart Superannuation calculator at moneysmart.gov.au, accessed 28 February 2023. The calculation assumes savings of $20 per week for a time period of 30 years. The calculation assumes the interest compounds annually. The interest rate assumed is 6% p.a. net of fees and taxes. The calculation assumes that earnings are reinvested. Results are shown in today’s dollars, which means they are adjusted for inflation of 4% p.a. The information should not be used as a guide to future performance of any investment. Investment returns can be positive or negative and this does not guarantee a future outcome. Check with your chosen savings product provider in regard to actual interest calculations. The calculation provides an estimate of the future value of savings, which could vary significantly over time if any change is made to these assumptions. These figures are provided only to demonstrate the principle of compounding. They are not intended to represent projected earnings in a QSuper Accumulation account.

How to add money to your super

Along with your employer’s contributions, if you are under age 75 you can add money to help grow your super.

The contributions you can choose to make are different to the Super Guarantee (SG) contributions your employer must make.

There are 2 types of voluntary contributions:

- after-tax contributions from your take-home pay or other money you have

- before-tax contributions such as salary sacrifice

After-tax voluntary contributions

Adding extra money to your super from your after-tax money can be called making personal super contributions, voluntary super contributions, after-tax contributions, or non-concessional contributions.

It's different to your employer’s SG contributions or before-tax contributions such as salary sacrificing.

You can make after-tax contributions to your super as a one-off, or setup regular transfers.

With this type of contribution, you’ve already paid tax on your money, which means it might be money you have in your bank account, so there’s no more tax to pay when you put it in your super account, unless you claim it as a deduction.

But there’s a limit to how much you can add to your super, called contribution caps. In 2024-25, the cap for after-tax contributions is $120,000 per year. You can also bring-forward up to 3 years of cap ($360,000), if your total super balance was less than $1.68 million last financial year. But if your total super balance was $1.9 million or more at the previous 30 June, your after-tax contributions cap is nil.

Use our Super Projection Calculator to see how much you could grow your super by adding money now.

How making after-tax voluntary contributions can benefit you

Grow your super

Any extra money you add to your super now can make a big difference to how much you end up with.

Get a tax deduction

When you add money from your pay or your bank to your super, you may be able to get a tax deduction for it. You can find out more about how it works here.

Get more from investments

In super, you generally pay up to 15% tax on investments before you retire. This tax rate can be lower compared to other ways of saving where your personal tax rate may be higher.

You might be eligible for a government bonus

If you earn less than $60,400, you may be able to get a bonus from the Australian Government in your super if you make an after-tax contribution. This is known as the super co-contribution.

You can be rewarded for making voluntary contributions to your super

Find out how