Changes to super from 1 July 2024

01 July 2024

5

min read

Keep on top of your super by understanding the key changes from 1 July 2024.

Here’s a summary of changes to super that might affect you.

Along with your employer’s contributions, you can add money to help grow your super. But the government sets limits on how much you can tax-effectively add to your super each year, known as contribution caps. Contributing too much might mean you pay extra tax.

- The before-tax contribution cap in 2024-25 is $30,000, which is up from $27,500 in 2023-24.

- The after-tax contribution cap in 2024-25 is $120,000, which is up from $110,000 in 2023-24.

New investment options you can choose Show content

From 1 July there’s a new suite of investment options that you can choose.

Our new investment menu features:

- 15 carefully designed choice options if you want to choose your own investment strategy. We offer 8 options we’ve designed and manage and 7 asset class options if you want to mix and manage your own portfolio, and/or

- our Lifetime option for Accumulation account holders where you let us invest for you.

Find out more about our investment menu changes in our March Product update. You can find details of changes to our Lifetime option in our May Product update.

Changes to administration fees Show content

We’re focused on strong long-term investment returns and competitive fees, and providing the information and access to advice you need to manage your super and retirement.

We’re making changes that aim to make sure our fee structure is consistent, fair and transparent.

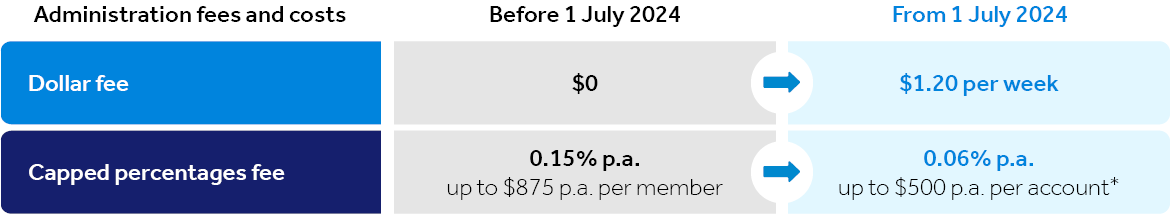

These are changes we made to administration fees from 1 July 2024:

- We have introduced a weekly dollar fee of $1.20 per week, per account.

- We have changed the capped percentage fee cap from 0.15% up to $875 p.a. per member to 0.06% up to $500 p.a. per account (this cap does not apply to the new weekly dollar fee, or costs met from reserves).

Here is what the change looks like for Accumulation accounts and Income accounts.

*Additional administration fees apply to Self Invest. These are not subject to this cap.

- If you have a Lifetime Pension, we’re reducing the administration percentage fee from 0.15% p.a. to 0.11% p.a.

- If you have Self Invest, we’re reducing the administration percentage fee from 0.15% p.a. to 0.10% p.a. The percentage fee cap won’t take into account money you hold in Self Invest.

Read more about these changes on our information hub and in our May Product update.

Insurance premiums for most QSuper Accumulation account holders changed from 1 July 2024.

How this impacts you depends on your age, occupational rating, and types of insurance cover you hold.

The main changes are:

- Death cover premiums decreased, on average by 7.8%

- Total & Permanent Disability premiums decreased, on average by 17.7%

- Income Protection premiums decreased, on average by 5.8%

There are 2 other changes:

- We updated occupational ratings from 1 July 2024. Occupational ratings are a way that you can personalise how much you pay for your insurance to better reflect your job or occupation. Depending on your job, you may pay less or more if you apply an occupational rating.

- We changed the ‘pre-existing exclusion’ period to 2 years, instead of 5 years, for new insurance cover applications. The ‘pre-existing exclusion’ period is where we won’t pay out an insurance benefit if you had signs or symptoms of your illness or injury before your cover with us began.

Learn more about the insurance we offer.

We’re changing how we rebate tax (Accumulation accounts only) Show content

From 1 July 2024, we changed the way that we pass back the benefit of tax deductions we claim to you.

From 1 July, we pass the benefit to you of tax deductions we claim in 2 different ways:

- Directly to your account as a tax rebate.

- Indirectly by retaining it in the fund for the benefit of all members.

To be eligible for the direct tax rebate you must have had contributions tax deducted from concessional contributions paid into your QSuper account during the financial year. If the rebate you would otherwise be eligible for is more than the amount of contributions tax deducted, your direct rebate will be capped at this amount and any remaining rebate amount will be retained in the Fund.

Any direct rebate that you’re eligible for will be credited to your account on 30 June each year. If you close your account during a financial year, the rebate will be calculated and included in your final balance.

We explain these changes in our May Product update.

You might like to get financial advice

Get the most out of your super and be confident you are making informed decisions.

1. Ordinary time earnings (OTE) salary is generally what you earn for your ordinary hours of work, including commissions, shift loadings and selected allowances, but not overtime payments. ATO List of payments that are ordinary time earnings, at ato.gov.au accessed 26 March 2024.