Annual Investment Update: How your money was invested for a smooth ride

31 August 2021

5

min read

QSuper’s Chief Investment Officer Charles Woodhouse led our online Annual Investment Update to explain how the Investments team managed your money during 2020-21.

Each year the QSuper’s Investments team report how they managed the money of the people who matter most to QSuper: you.

Because COVID-19 continues to affect us, we held the Annual Investment Update online for the second year running, with a series of seminars conducted through August.

The investment update is your opportunity to hear directly from the Investments team about the performance of your superannuation investments and the investment strategy underlying that performance.

Chief Investment Officer Charles Woodhouse said that, despite a second year of economic volatility, members experienced a fairly smooth ride in 2020-21.

Investing in an era of volatility

Mr Woodhouse said getting on top of the coronavirus pandemic was the defining feature of the past financial year, with the economic environment affecting a variety of investment assets.

Equity prices were around 35% higher. Many commodity prices rose higher still. Copper prices, for example, rose more than 70% on the promise of large infrastructure spending in China and the United States, and a global focus on green infrastructure, such as electric vehicles, battery storage and solar.

Against these rises, there were some losses on asset classes such as bonds and safe-haven currencies.

For the 2020-21 financial year, QSuper produced a return of 13.7% for our Accumulation account Balanced option over the year1, which compared very favourably to the option’s objective to exceed CPI + 3.5%.

One-year results for the Income account, for members who have fully retired, also exceeded the results for a typical year. The Income account Balanced option produced a return of 14.9%2, well above the five- and 10-year average returns.

Our unique approach with your investments

QSuper has maintained our unique approach for managing risk for members in our default investment option, Lifetime.

The principles and behaviours underpinning the way QSuper invests mean the Balanced option’s returns are sourced across asset classes and do not rely on a one-trick pony or single asset class to produce returns.

This diversified approach means investments in equities and commodities, as well as investment in unlisted assets like infrastructure and real estate.

It also means investments in other asset classes like bonds and safe-haven currencies, which are designed to do well when equities perform poorly.

We also continue to offer the only default investment product in Australia that takes two factors into consideration for a member’s investment strategy.

One is age, and the other is the balance in your Lifetime account. The higher the balance and the older the member, the more conservative the investment strategy to minimise the risk of loss.

A changing market landscape - an evolving strategy

Your returns

Mr Woodhouse told members the aim was to perform well each year as well as over the long haul.

Since the market downturn in February and March of 2020, QSuper had started increasing allocation to risk assets for Lifetime account holders and other diversified investment options, to further take advantage of market recoveries and support returns across all Lifetime groups, he said.

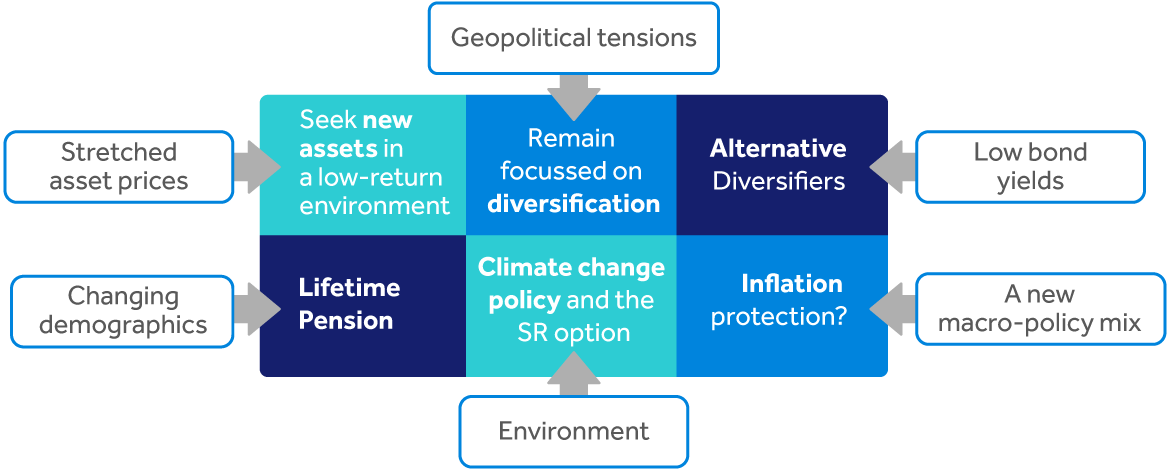

However, global risks continued to encourage diversification in investment portfolios, so the portfolios would be protected should one or more of the risks derail the economic recovery, he said.

Responsible investing

QSuper made significant inroads into two elements of responsible investing over the past year, committing to net zero carbon emissions by 2050 and redesigning our Socially Responsible option and managing it in-house.

Mr Woodhouse said that back in 2019, members were asked for their views about the Socially Responsible option. You told us you wanted to target specific environmental and social concerns, while seeing tangible real-world outcomes.

Your preferences included targeting clean energy, green building, environmental conservation, and waste reduction and recycling. You also wanted the option to target food and water scarcity, medical and technological innovation, education, and health care. In the 2020-21 financial year, QSuper’s Investments team applied these preferences to a combination of equities, unlisted assets and green bonds.

These positive environmental and social impacts now form one of the Socially Responsible option’s twin objectives; the other is to deliver on the financial objectives of strong returns with fewer ups and downs.

What do members think about the redesigned option?

After 12 months, we have seen an increase of 82% in the number of members invested in the Socially Responsible option, and a 50% rise in the average balance.

increase in funds under management

increase in members invested in the fund

increase in the average balance

Lifetime Pension

Your concerns about running out of money in retirement also prompted us to introduce an innovative new product in March 2021.

Lifetime Pension, for which eligibility conditions apply, ensures an income for life. It provides a fortnightly income, no matter how long you live. Importantly, it enables you to be confident you will receive an income for the rest of your life and that your super will never run out.

Mr Woodhouse said QSuper’s two retirement products, Retirement Income account and Lifetime Pension, offer unique benefits that, when used together, can provide for a more complete retirement solution.3

What you can do next

Get more hands-on with your super to feel more confident about tomorrow by logging in to Member Online to review your investments.

1. Past performance is not a reliable indicator of future performance. Please note, the figures shown reflect the returns of the investment options, not the returns of your investment as these returns do not take into account the timing of contributions, investment switches or withdrawals. Your actual returns will differ depending on the unit prices applied to your investment option(s) at the time of transaction.

2. Past performance is not a reliable indicator of future performance. Please note, the figures shown reflect the returns of the investment options, not the returns of your investment as these returns do not take into account the timing of contributions, investment switches or withdrawals. Your actual returns will differ depending on the unit prices applied to your investment option(s) at the time of transaction.

3. This content is provided for information purposes only and should not be taken as financial product advice. You should get professional advice before making an investment decision.