Investment outlook: diversification remains key

13 July 2020

5

min read

The QSuper Investments team outline some key risks on the road to recovery, and the importance of owning a portfolio of assets that are truly diversified.

Coronavirus has given us a year very different to what the world expected and our thoughts are with those families who’ve been affected by this public health crisis and its economic consequences.

Australia has (so far) mostly managed to handle the crisis better than many, maintaining at very low levels the number of positive COVID-19 cases as a share of its total population.

The economic rollercoaster thus far

Unfortunately, implementing public health measures across the world has come at an enormous economic cost, tipping the global economy towards what may be its largest recession for a century. At the height of the crisis, many feared it would take years or a lifetime to get back to normal, and that the economy and asset prices would be depressed for a prolonged period. However financial markets are inherently forward-looking and since collapsing by around 30% in March, major stock markets have generally recovered more than half their losses at the time of writing. Drivers of this recovery include:

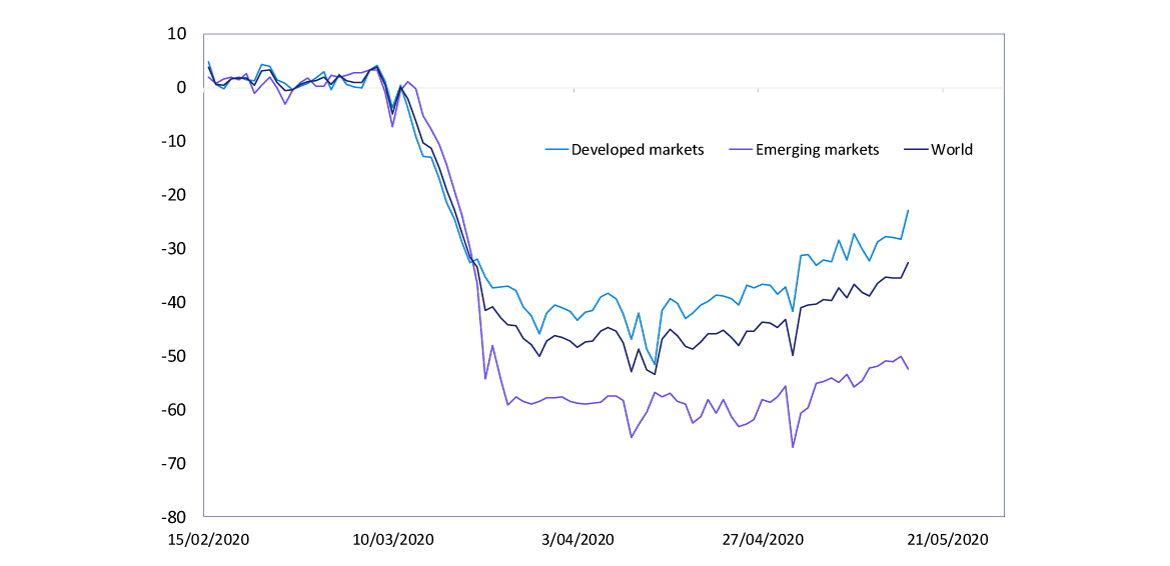

- Improved mobility – as lockdown measures across the world are progressively relaxed, people are beginning to once again visit retail, workplace and transit centres. The graph below shows one summary measure of activity, Google’s ‘mobility tracker’ (if your iPhone has location services enabled, you’re contributing). Global mobility in April was 50% below January levels, but recovered to be only 35% below by May.

Global people movement

Impact of social distancing on mobility – deviation (%)

(number/length of visits* vs median day from 3-Jan to 6-Feb)

* Weighted average of four types of activities – transit stations, workplaces, retail and outdoor recreation

Source: Google mobility tracker

- Policy support – after focusing on austerity since the 2008 global financial crisis, COVID-19 has shocked governments into different action. For example, the United States is spending $3 trillion dollars (equal to 15% of the economy) on cash handouts, unemployment benefits and other assistance alone. It has also ushered in a new era of policy coordination, with central banks committing to near zero borrowing costs for governments and printing money to extend emergency loans to businesses.

The road to recovery

Despite an improved economic outlook, QSuper’s Investments team remains wary. Key risks on the road to recovery are:

- False start – social distancing and contact tracing could create a pathway to economic normality even in the absence of a vaccine. However, on ‘reopening’, several countries have experienced a second wave of infection, prompting a reintroduction of lockdown measures in some instances. Closer to home Victoria has been a prime example in Australia.

- Anti-globalisation – trade and geopolitical tensions between the United States and China have been reignited. Post coronavirus, countries may revisit trade dependencies and look to insource supply chains.

- Vaccine – this recession, unlike others, cannot be resolved purely by governments and central banks providing more money; it ultimately requires a medical solution for life (and the economy) to get back to normal. However, the 12-18-month timeline nominated for developing and mass production of a vaccine might be ambitious.

Diversification remains key

COVID-19 is creating a more differentiated and uncertain environment. Outcomes between sectors are the clearest example with healthcare and information technology businesses benefitting while hospitality and tourism operators suffer tremendously.

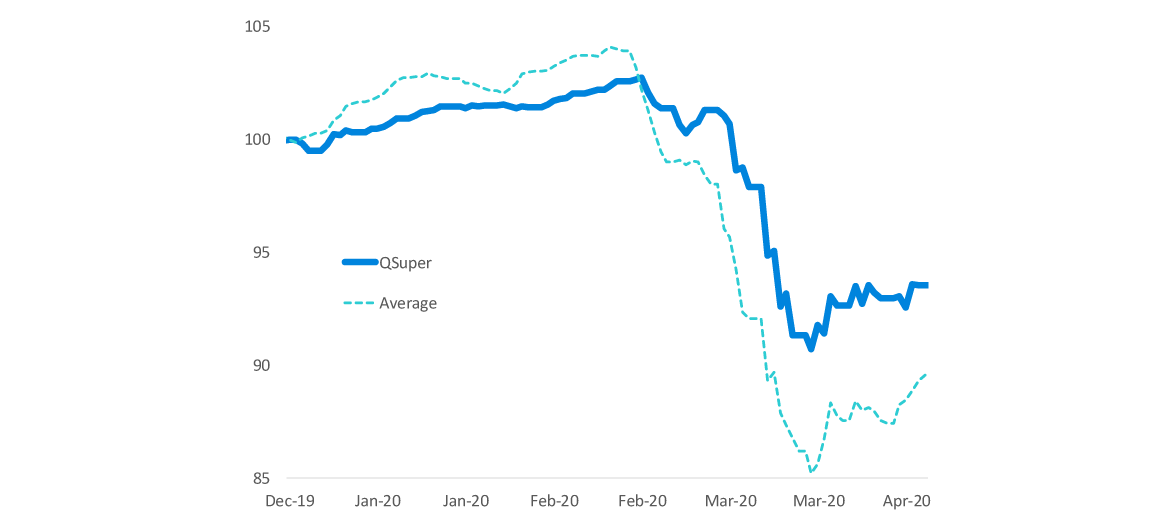

This divergence is also occurring at a national level as many emerging markets do not possess the medical infrastructure or fiscal capacity to support their economies in the same way as their more established neighbours. Against this backdrop, owning a portfolio of assets that are truly diversified across companies, sectors, geographies and asset classes takes on even greater importance. The following graph shows how QSuper’s risk balanced investment strategy has performed against other superannuation funds since the pandemic’s onset.

Unit price performance, 2019-20^

Balanced equivalent options – Unit prices (Index, 28/6/2019 = 100)

^ Average of First State Super, SunSuper, HostPlus, LGIA Super, AusSuper, UniSuper Past performance is not a reliable indicator of future performance. Based on the QSuper’s Accumulation Account Balanced Investment option. SuperRatings Fundamentals report as at. This finding is based on the industry average measures for $50,000 invested in the Balanced investment option using the actual net returns and fees from the current product disclosure statement when we printed the report. It doesn’t include the cost of insurance. SuperRatings does not issue, sell, guarantee or underwrite this product. Go to www.superratings.com.au for details of methodology.

The COVID-19 situation continues to evolve swiftly. As new information about the virus and policymaker’s response comes to light, the Investments team will continue to refine its market view and position the portfolio1 to capitalise on emerging investment opportunities.

This investment strategy is for the QSuper Accumulation account Balanced investment option only. Past performance is not a reliable indicator of future performance. Product issued by the QSuper Board (ABN 32 125 059 006, AFSL 489650) as trustee for QSuper (ABN 60 905 115 063). This is general information only. Consider the PDS on the QSuper website and, where necessary, seek professional advice to see whether QSuper is right for you. © QSuper Board

1. The term ‘QSuper portfolio’ is used to refer collectively to the underlying portfolios of assets that in combination make up the individual asset allocations of the QSuper Lifetime, Balanced, Moderate, and Aggressive investment options. Each investment options has a different objective, risk profile, and asset allocation. Visit qsuper.qld.gov.au for more information