Coronavirus and market volatility

09 March 2020

6

min read

The novel coronavirus outbreak, discovered in China in late December 2019, has caused share market volatility that provides good headlines for news agencies and sometimes creates concern for investors. In times of volatility, it’s important to take a deep breath and consider your long-term perspective.

There are many things that cause share market volatility. It can be a natural disaster such as a tsunami. Or a political event such as Brexit. It can be a set of economic data. Or, as right now, a global health event. Volatility, particularly when reported widely on news sites, understandably creates investor worry. Before taking quick action with long-term investments and crystallising point-in-time returns, members should consider the bigger picture.

Is the coronavirus different?

Every external market event is different in detail to the last one. All are common in that they cause short-term market fluctuation.

Precisely how this virus will impact markets long term is not fully known. In an economically interconnected world though, there are concerns that company earnings in developed markets will be impacted as the virus spreads. Share markets across the globe have declined in recent days, pricing in this concern.

This recent weakness in equities is not surprising. Since the virus first emerged in China, share markets had continued to rise. No risk of the virus disrupting the global economy had been priced. QSuper has held equities at the lower end of ranges, prior to the recent correction, mitigating the impact of the recent correction in shares slightly.

On the flip side, share markets did have a good run the past 12 months. Media reports generally measure the share market by the S&P/ASX 200 index. At the time of writing on Monday, 9 March 2020 the index was at 5,839.8 – compared to 6,180 on the 11 March 2019.

So what should you do?

We can’t tell you what investment decision you should make, but we do encourage you to find out more. We know how important it is to hear about the performance of your investments and be confident with the balance of risk and reward you’re seeking. QSuper staff are available to talk generally with you anytime. QSuper also gives you access to over the phone financial advice3 on specific topics related to your QSuper account.

We are also looking forward to meeting members at our Annual Investment Update later this year, which we hold across the state. Here are the common questions from the 2019 events.

How we invest

QSuper’s investment strategy is to invest in a “risk-balanced” way; we focus on risk allocation not asset allocation. It’s a diversification approach different to that taken by most other superannuation providers and a factor in QSuper receiving the inaugural SuperRatings ‘Smooth Ride’ award in 2020, recognising us as the fund that has best weathered the ups and downs of the market, while also delivering strong outcomes.2

What it means practically for our members in QSuper’s default and other diversified options (excluding the SR option) is decreased equity risk and increased exposure to other asset classes, led by bonds (which tend to go up and down at opposite times to shares), as well as direct infrastructure, real estate, private equity and alternative investments.

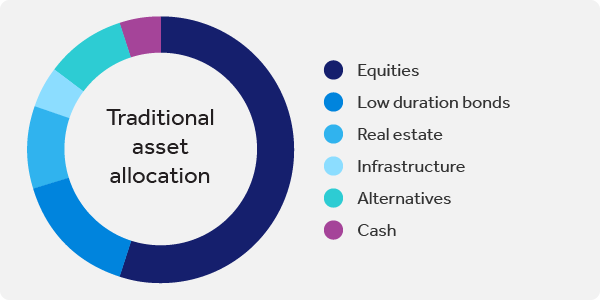

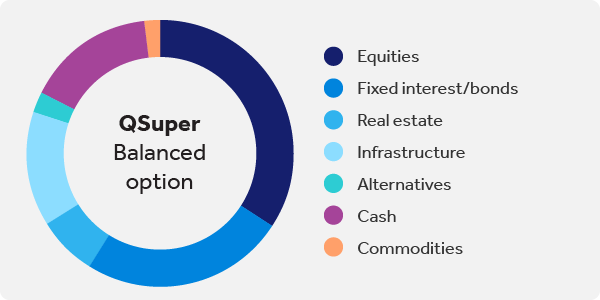

Visually, here’s what it looks like:

Asset allocation

Traditional asset allocation: Higher reliance on equities for growth.

Source: The asset allocation in this chart is for the SuperRatings SR50 Balanced (60-76) Index median fund. SuperRatings does not issue, sell, guarantee or underwrite this product.

QSuper Balanced: Strategic use of long-term bonds for more diversified risk.

Source: The asset allocation of the QSuper Balanced option for the accumulation account.

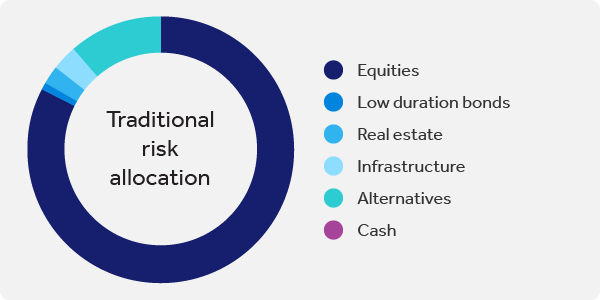

Related risk allocation

Traditional risk allocation: Predominance of equity risk.

*Risk allocation is defined as contribution to volatility

Source: The risk allocation is based on QSuper analysis of the SuperRatings SR50 Balanced (60-76) Index median fund asset allocation. SuperRatings does not issue, sell, guarantee or underwrite this product.

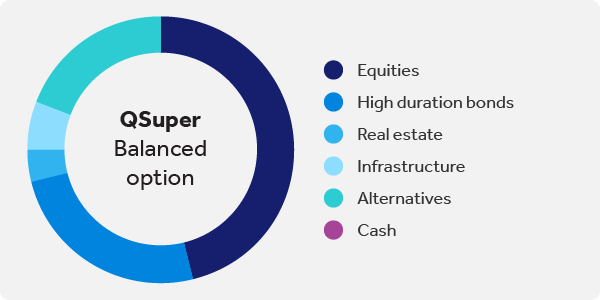

QSuper Balanced option: More balanced risk – far less equity risk.

*Risk allocation is defined as contribution to volatility

Source: The asset allocation of the QSuper Balanced option for the accumulation account.

When markets are volatile what does the Investment team at QSuper do? We stick to our long-term strategy of risk-balanced diversification, which involves behind-the-scenes daily management of the shorter-term asset allocations within the QSuper portfolio.3 This daily management occurs in all market conditions.

Find our more about our investment options.

1. Advice fees may apply. Refer to the Financial Services Guide for more information.

2. SuperRatings does not issue, sell, guarantee or underwrite this product. Go to www.superratings.com.au for details of its ratings criteria. Past performance is not a reliable indicator of future performance. Ratings, awards or investment returns are only one factor that you should consider when deciding how to invest your super.

3. The term ‘QSuper portfolio’ is used to refer collectively to the underlying portfolios of assets which in combination make up the individual asset allocations of QSuper Lifetime and the Balanced, Moderate and Aggressive investment options.