QSuper’s strong returns with less volatility

18 July 2019

5

min read

QSuper’s unique investment strategy has delivered consistently strong returns for our members, making us an industry leader over the short and long term.1

Queensland’s largest superannuation fund has emerged top of the rankings for its investment performance over the past year and is confirmed as an industry leader for the past decade.1

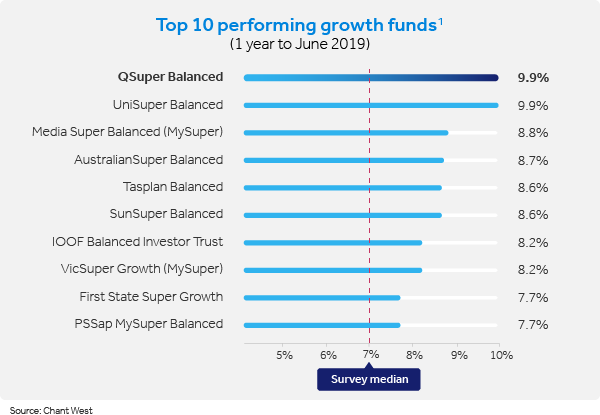

Research agency Chant West has given the top billing to QSuper’s Accumulation Account Balanced Option.

Its return over the past year has been 9.9% and it has returned an average 9.5% over the past 10 years.

This compares with median returns of 7% this year for like funds rated by Chant West and 8.8% a year for the past decade.

Chant West said in a media statement that QSuper had executed its strategy well over this year and many years.

“QSuper, like most not-for-profit funds, has a meaningful allocation to unlisted assets such as property, infrastructure and private equity. However where its strategy is unique is that it further smooths out returns for members by investing significantly less in listed shares than other funds.”

“Against that, it maintains a significant allocation to long duration bonds which carry sharemarket-like risk but are a better diversifier against sharemarket falls than traditional bonds.”

The QSuper head of investment strategy, Mr Damian Lillicrap, said QSuper’s great relative outcomes reflected contributions from a range of different asset classes.

“Most funds’ balanced options are more concentrated into equities than QSuper’s, and after the lows of the GFC it has been a great decade for equities, so most funds have done well.

“QSuper has done better due in part to a range of assets that it has invested into that a mum and dad investor simply can’t access themselves. QSuper has had great returns from direct infrastructure, direct property and private equity, that people simply can’t directly access if they are trying to manage their Super themselves via an SMSF.”

QSuper’s investment strategies have shifted funds away from reliance on the stock market.

“High returns are often associated with higher risk but via lowering equity weights and having a more diversified approach QSuper Balanced members have experienced considerably less risk than other high returning funds,” said Mr Lillicrap.

As such members have experienced the best of both worlds, great returns and lower risk, the result of fabulous execution of a diversified investment approach that was put in place in 2011.

Find out what else to consider when comparing Australia’s top performing super funds.

Find out more about QSuper's investment performance

Read more

1 Past performance may not be a reliable indicator of future performance. QSuper’s Accumulation account, Balanced Option only, ranked fourth. The Chant West data is based on information provided by third parties that is believed to be accurate at 30 June 2019. Based on the returns of investment options in Chant West’s Growth universe over the period to 30 June 2019 with returns reflected after investment fees and tax. Chant West’s Financial Services Guide is available at chantwest.com.au

2 These are case studies provided for illustrative purposes only. Past performance is not a reliable indicator of future performance. This is based on data sourced using the 10-year annual performance numbers (financial year) for the last 10 years published by Chant West for each fund. Assumed starting balance of $100,000 invested in the accumulation balance option. Using a salary of $70,871 for teacher, $70,702 for nurse, $88,077 for Police Sargent, then using a 3% salary indexation to decrease the salaries to 10 years ago. Contribution rates of 17.75% for teacher and nurse and 24% for Police Sergeant. Contributions received annually at the end of the year and increased in line with the award rises. Assumes no withdrawals, no switching and no insurance premiums. The QSuper returns are being compared to the medium result each year for 10 years as published by Chant West.