Performance: past and future winners

04 March 2019

5

min read

In terms of superannuation investment performance, we think that one-year performance tables get more attention than they deserve. Superannuation, for most people, is a multi-year and multi-decade commitment.

The superannuation investment industry is a great source of publicly available data.

One-year performance tables can be a special media favourite as they give commentators and journalists the chance to write stories with black and white contrasts.

Lights can be shined on the happy winning fund in one corner, and the unhappy last place finisher in another.

The one-year performance tables may get more attention than they deserve. Superannuation, for most people, is a multi-year and multi-decade commitment.

One-year returns are “noise.”

To note: The QSuper Balanced investment option finished #1 for 1-year performance to the end of December.1 This article is being written to put that #1 ranking in perspective for investors.

Written superannuation investment performance objectives are generally measured over 10 years. Incidentally, the QSuper Balanced investment option finished #1 for 10-year returns to the end of December 2018 (Figure 3) in the closely watched SuperRatings survey2 as well as the Chant West results.3

Strong one-year returns viewed in isolation may indicate little skill and a lot of luck. Sustained performance measured over longer timeframes are more likely an indicator of good strategy and investment management over that period.4

However, it is possible that the amount of publicity given to one-year returns might cause members of some super funds to think they could do better by switching to investment strategies that top one-year performance tables.

So, what might be the result of investing in recent/past winners?

The table chaser versus steady-as-she-goes

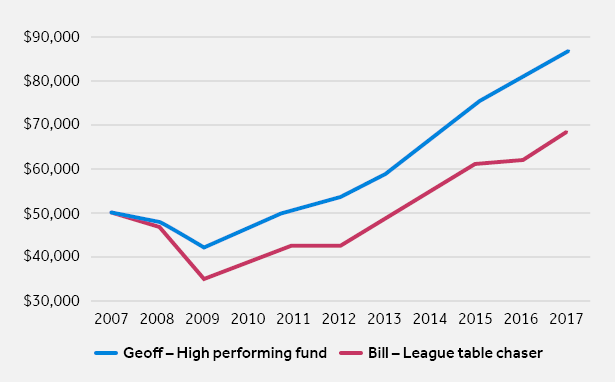

In short, not good, as returns received in this illustration by two fictitious people reveals (Figure 1).

There’s “Bill,” a league table chaser — he changes super funds on an annual basis to invest in the investment option that finishes #1 in Super Ratings’ Balanced fund category in the year after they have topped the one-year performance table.

Then there’s “Geoff,” who has stuck with the QSuper Balanced investment option through the same 10 years as Bill.

They both start with $50,000 and no additional contributions and cashflows go into their super accounts.

At the end of the 10 years to 30 June 2017, Bill the league table chaser’s balance has risen to $68,050 while steady-as-she goes Geoff’s account has hit $86,697.5

Figure 1: Chasing returns versus steady-as-she goes

It’s no surprise that investing in past winners may be a letdown (Figure 2). In the investment world, the future is rarely a straight-line continuation of the past.

Figure 2: Past winners rarely finish top the following year

| Fund name |

1-Year to 30 June returns (%) |

Financial year in which fund finished #1 in SuperRatings’ balanced fund category |

Placement in SuperRatings’ balanced fund category performance table at end of the following financial year |

| Catholic Super – Balanced |

21.03 |

2007/08 |

13 |

| MTAA Super – My AutoSuper |

-2.13 |

2008/09 |

41 |

| Rest – Core Strategy |

-7.82 |

2009/10 |

9 |

| Local Government Super Accum – Balanced Growth |

12.78 |

2010/11 |

25 |

| Catholic Super – Balanced |

11.43 |

2011/12 |

14 |

| CSC PSSap – MySuper Balanced |

2.40 |

2012/13 |

24 |

| Rest – Core Strategy |

18.42 |

2013/14 |

9 |

| Telstra Super Corp Plus – Balanced |

15.81 |

2014/15 |

15 |

| CSC PSSap – MySuper Balanced |

12.18 |

2015/16 |

36 |

| BUSSQ Premium Choice – Balanced Growth |

7.00 |

2016/17 |

34 |

The superannuation funds named in this table are drawn from the funds that comprise the SR 50 Balanced Fund survey. Returns are for the 10-years to 31 December 2018, and are after fees and taxes

and assume no additional contributions. The actual returns received by members would vary depending on contributions, investment options chosen and cash flow timings. Past performance is not a reliable indicator of future performance.

www.superratings.com.au.

The QSuper Balanced investment option doesn’t aim to be a one-year or even year-on-year performance winner. That’s not what it’s designed to do.

Rather, it aims to deliver strong long-term returns with fewer ups and downs.

The odds of long-term success are more likely to be higher from investing in superannuation strategies built around well-diversified portfolios with multiple and uncorrelated (investments that don’t move in lock step with each other) sources of risk and return. Find out more about QSuper’s diversification.

Figure 3: QSuper Balanced Fund topped SuperRatings 10-year performance table

| Rank |

Product Name |

10-year return (%) |

| 1st |

QSuper – QSuper Balanced |

8.60 |

| 2nd |

TelstraSuper Corp Plus – Balanced |

8.51 |

| 3rd |

AustralianSuper – Balanced |

8.38 |

| 4th |

UniSuper Accum (1) – balanced |

8.37 |

| 5th |

Rest – Core Strategy |

8.37 |

| 6th |

CareSuper – Balanced |

8.36 |

| 7th |

Equip MyFuture – Balanced Growth |

8.31 |

| 8th |

Hostplus – Balanced |

8.31 |

| 9th |

Cbus – Growth (Cbus MySuper) |

8.21 |

| 10th |

CatholicSuper – Balanced MySuper |

8.18 |

| 50th |

MTAA Super – My AutoSuper |

4.91 |

Returns in this table are drawn from the 50 superannuation funds that comprise the SR 50 Balanced Fund survey and are for the 10-years to 31 December 2018, and are after fees and taxes. The actual returns received by members would vary depending on contributions, investment options chosen and cash flow timings. Past performance is not a reliable indicator of future performance.

Source: www.superratings.com.au.

The views of the authors are not necessarily the views of the QSuper Board. This information is general information only, and you should get professional advice before relying on this information. Past performance is not a reliable indicator of future performance. Each of our investment options has a different objective, risk profile, and asset allocation. Visit qsuper.qld.gov.au for more information.

1 Chant West media release 17 January 2019. This is the return for the option before administration fees and the actual returns received by members would vary depending on contributions, investment options chosen and cash flow timings.

2 Source: www.superratings.com.au. QSuper Balanced Option only. SuperRatings SR50 Balanced Index (60-76) median based on cumulative returns compounded annually after fees and for initial $50,000 invested over the period to 31 December 2018

3 Source: Chant West data to 31 December 2018. See Chant West media release 17 January 2019 for methodoloty. This is the return for the option before administration fees and the actual returns received by members would vary depending on contributions, investment options chosen and cash flow timings.

4 Past performance is not a reliable indicator of future performance.

5 Returns calculated by QSuper using SuperRatings data (www.superratings.com.au). Returns for each financial year ending 30 June are calculated after fees and taxes, and assume no additional contributions and cashflows to the two starting balances of $50,000. Past performance is not a reliable indicator of future performance.