Snoozing on your super? It could be costing you

07 August 2025

3

min read

It’s hard to think about saving for the future when life keeps getting more expensive.

But giving your super a little attention now can make a big difference later.

And getting advice early can set you up for success.

Make your money work harder, sooner

Super is your money. It's also a long-term investment, so taking interest in it early can set you up for a

better future.

Building up your balance can be as simple as giving your account a regular check-in and making a few smart

moves along the way.

And the good news? There are easy ways to grow your super without costing you extra today.

Why pay attention to your super early?

- Tap into compound earnings

- Avoid paying extra fees on lost super

and insurance

- Get your investment mix right for your stage of life

- Set a clear goal for retirement and feel confident about your money

What are compound earnings?

Compound earnings are when you earn returns on your super investments, and then those returns earn

even more returns. The earlier you add to your super – even if it’s just a little bit – the longer it has to grow.

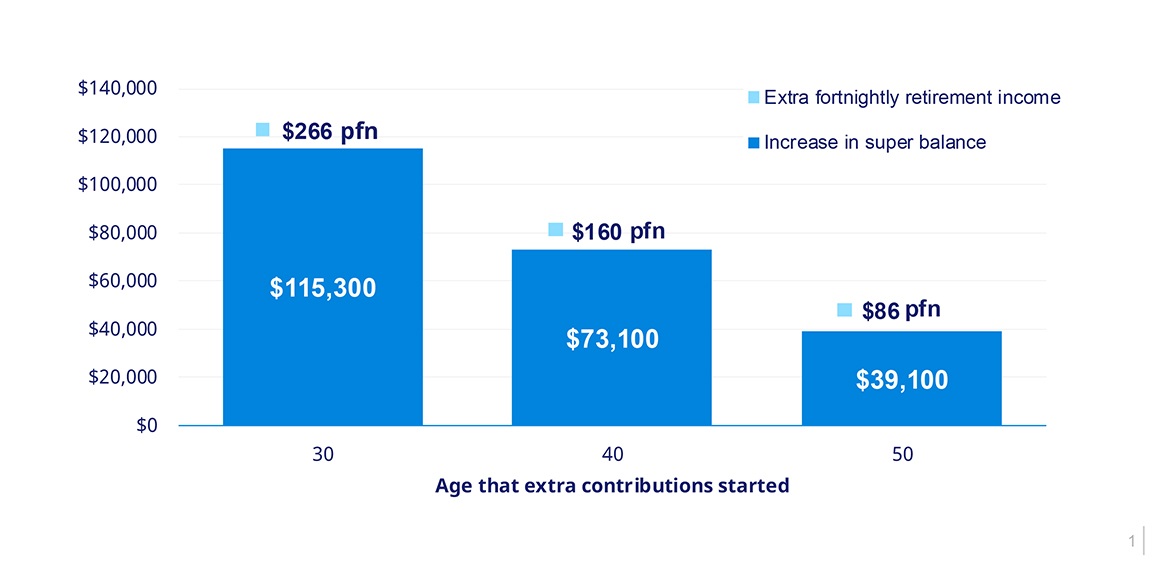

Is adding extra to your super now really worth it?

We've crunched the numbers to see how much more you could get if you use the power of compound earnings and

start early.

Let’s see how it works.

Case study: Salary sacrifice

Charli earns $78,000 a year. They want to retire at age 65. They've decided to use salary sacrifice

to add to their super before tax.

- They make a $100 salary sacrifice contribution to their super every fortnight.

- This reduces their take home pay by $68 a fortnight.1

Here's how much this may add to their super if they start at age 30 versus 40 or 50.

Increase in super balance at age 65

We got these results using the Australian Retirement Trust contributions calculator,

the case study info above and the assumptions and limitations that form the basis of the calculator at australianretirementtrust.com.au/learn/tools/super-contributions-calculator.

Assumed rate of return is 6.0% p.a., based on the Medium/High Investment strategy and assumed discount rate of 3.7% p.a.,

which reflects wage inflation. All amounts are in today's dollars and exclude any other sources of income including

the Age Pension.

How do I choose the right investment option?

How you invest your super can have a big impact on how much money you have when you retire. Even little changes

can make a difference.

If you’ve never changed your super investments, you might be in the default option. That works well for many members.

But it may not be the best fit for your age or goals.

Start with these 3 questions:

- How long do you plan to invest for? We have recommended timeframes on all our options.

- What level of returns do you want? You may want to grow your balance or keep it stable,

depending on your goals and timeframe.

- How much risk are you comfortable with? Think about how you might feel about your returns going

up and down.

Not sure where you sit? We can help with investing basics. And members can

get quick advice anytime through Member Online.

When should I get financial advice on super?

The earlier, the better – but it’s never too late.

Getting superannuation advice when you’re working can help you make the most of what you have now.

It can also build confidence in your financial future.

People often get advice when:

- their income changes

- they change jobs

- they’re starting a family

- they want to plan for retirement.

What our research shows

Australians who’ve had financial advice feel more confident about their financial future

compared with those who haven’t had advice (49% vs 30%).2

Advice at different life stages

If you’re new to financial advice, here are some suggestions to start you off. These topics are good to talk

about at any age, too.

| Age |

Popular topics |

| 20s–30s |

Combine lost super, set your investment strategy. |

| 30s–40s |

Review your insurance, start adding extra if you can. |

| 40s–50s |

Set retirement goals, plan contributions and withdrawals. |

Can I get free financial advice through QSuper?

When you have a QSuper account, you can get personal advice about your super

account at no extra cost.3

This advice can help you:

- Choose the right investment strategy for your goals.

- Grow your balance in the most tax-effective ways.

- Learn about contributions and what’s right for you.

- Understand your insurance options.

- Plan and fund your retirement.

5-step action plan to awaken your super

Start with these 5 small actions to set yourself up for a better future when you retire.

While you're there, search for multiple accounts and think about combining them to have one set of fees.

Set a goal for adding extra to your super – even $10 a week adds up.

Book in with a financial adviser to get help with your super (it’s part of your membership).

Register for a seminar or

workplace talk to learn more.

Take control of your money

Pay attention to your super now and give yourself more financial freedom

in the future.

It’s never too early or late to begin.

Talk

to an adviser

1. This calculation assumes no breaks in employment and current tax rates, which are all subject to change. We’ve provided this case study for

illustrative and educational purposes only and the members shown are not real. Also, figures may be rounded to make them easier to understand. You should seek advice from

a qualified licensed professional regarding your own circumstances.

2. Source: Survey of 1,000 Australians carried out by Ipsos on behalf of Australian Retirement Trust, September to November 2023.

3. Read more about your advice options at qsuper.qld.gov.au/financial-advice.

Representatives of ART Financial Advice Pty Ltd (ABN 50 087 154 818 AFSL 227867) give financial advice. ART Financial Advice Pty Ltd is responsible for the advice

it gives and is a separate legal entity. Read the Financial Services Guide at art.com.au/fsg for more information.