It's time to awaken your super

06 November 2024

5

min read

Now is a great time to get your super in order with these 6 steps, and make your super work harder for you.

If getting your super to work harder for you has been on your to-do list this year, follow these steps and awaken what might be one of your biggest investments in your lifetime.

How to help turn a little now into much more later

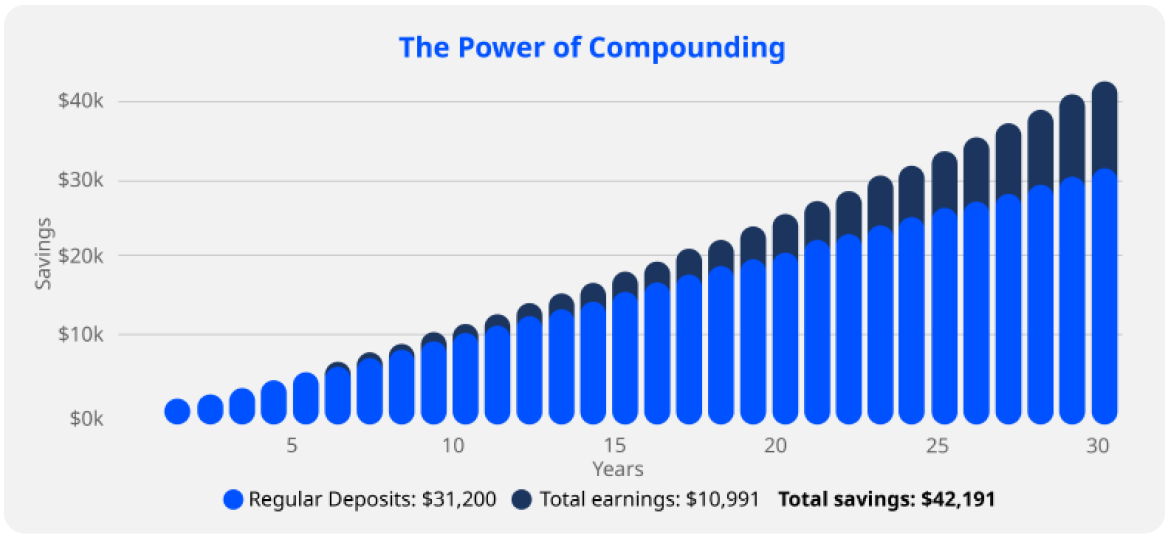

One of the benefits of putting money into your super is the power of compounding, which can help your savings grow faster.

Put simply, compounding means that as money grows by earning investment returns, these earnings also grow by earning returns, and so on.

While it's important to note that earnings in super can be positive or negative, super is generally a long-term investment. The longer you are invested, the more you can benefit from compounding, and the more likely it is that you'll overcome any short-term falls in investment markets.

How does compounding work?

Here’s an example of compounding. In this example, if you invest $20 per week (after tax) over 30 years, assuming a return of 2% p.a. (net of inflation, fees and costs and taxes), you could have over $40,000.1 Over $10,000 of that $40,000 total could come from investment earnings.

6 steps you can take now to get on top of your super

How much super do I need to retire? Show content

Use our Super Projection Calculator to help estimate how long your superannuation balance might last in retirement based on your desired annual income. Knowing how long your balance will last can help you plan for how much super you might need to retire.

Combine your accounts now and have more later. Consolidating super could save you money.

Before you combine super accounts, make sure you’re aware of any differences between them, including the differences in fees and costs, services and features. You should take note of the insurance cover you have as consolidating your account doesn’t automatically transfer any insurance cover you have with the other super fund.

You should consider if the timing is right and if you will lose access to benefits such as insurance or pension options, or if there are any tax implications if you consolidate your super. You may wish to talk to a financial adviser.

Understanding your appetite for investment risk can help you work out your risk profile and the kind of investor you are. With us you have access to a wide range of investment options you can choose from or combine. You can also change your choices as your circumstances change.

Money that’s paid into your super account is called super contributions. As well as employer super contributions, you can grow your savings by making extra super contributions from your own money. See the types of contributions you can make because even a little bit when you can afford it can make a big difference.

Consider getting financial advice so you can make confident decisions for your future and awaken your super monster.

1. The figures are illustrative only and we worked them out using the ASIC MoneySmart Superannuation calculator at moneysmart.gov.au, accessed 5 February 2024. The calculation assumes savings of $20 per week for a time period of 30 years. The calculation assumes the earnings compound annually. The earnings rate assumed is 6% p.a. net of fees and costs and taxes. The calculation assumes that earnings are reinvested. Results are shown in today’s dollars, which means they are adjusted for inflation of 4% p.a. The information should not be used as a guide to future performance of any investment. Investment returns can be positive or negative and this does not guarantee a future outcome. Check with your chosen product provider in regard to actual earnings calculations. The calculation provides an estimate of the future value of savings, which could vary significantly over time if any change is made to these assumptions. These figures are provided only to demonstrate the principle of compounding. They are not intended to represent projected earnings in our Accumulation account.

This is general information only. It’s not based on your personal objectives, financial situation or needs. So, think about those things and read the relevant Product Disclosure Statement and Target Market Determination at art.com.au/pds before you make any decision about our products. And if you’re still not sure, talk with a financial adviser.