Reading your Accumulation account statement

12 June 2024

5

min read

Your super will probably be one of the biggest investments of your life. Here are 6 things to check when you receive your 2024 annual statement.

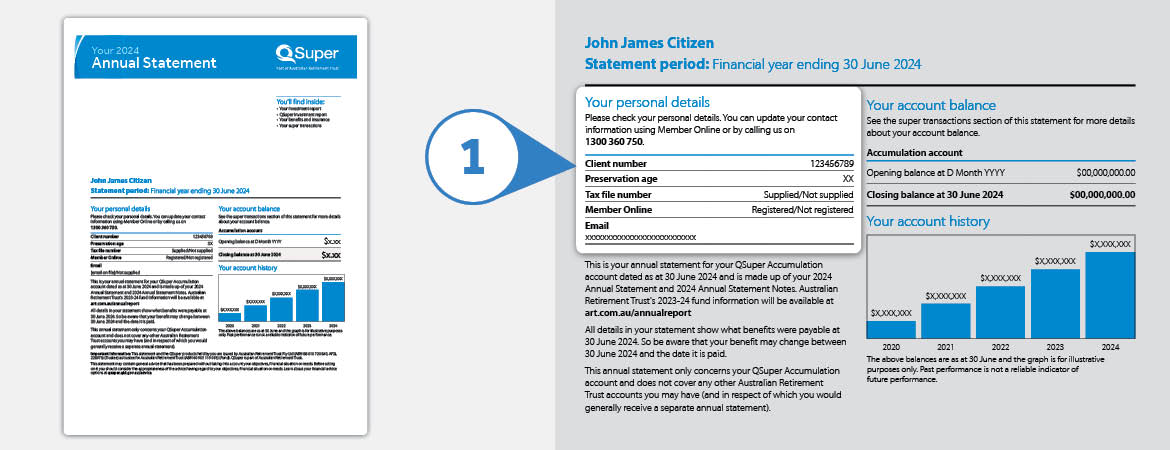

1

Check your personal details

The personal details section on your statement contains the following:

- Your client number, which is unique to you – like an account number.

- Your preservation age, which is the age you can access your super.

Make sure we have your tax file number on file. If we do, it will say “supplied”. You don’t have to give us your tax file number, but if we don’t have it, you might be charged extra tax.

Check whether you’re registered for Member Online. It’s the easiest way to keep up-to-date with your superannuation investments, contributions, insurance and account balance.

Finally, check your email address and postal address. You can make any changes quickly and easily in Member Online.

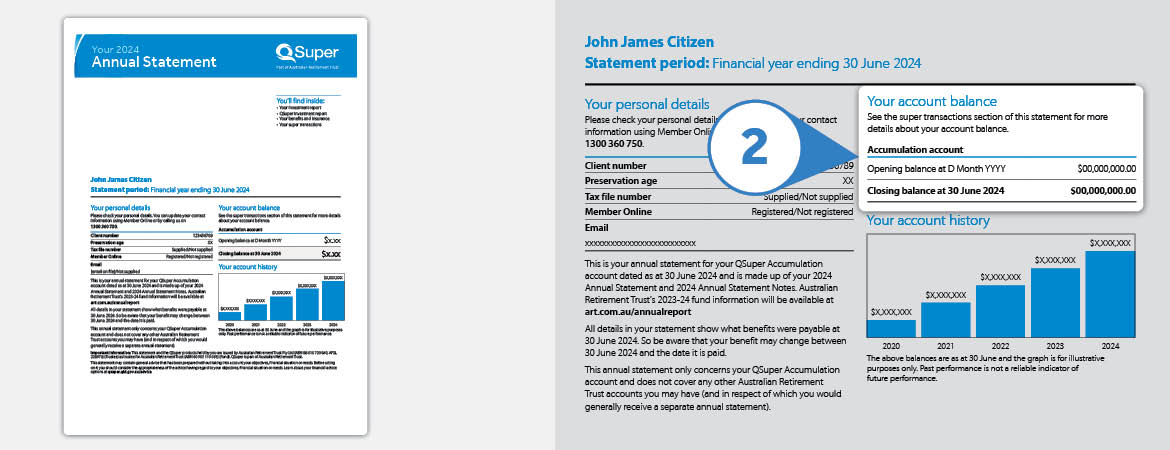

2

Check your account balance

Your annual statement will show your opening balance at the beginning of the financial year (or the date your account was opened), compared with your closing balance at the end of the financial year.

So that you can see how your savings are tracking over time, we have also included a graph showing your account balance as at 30 June for the last five years.

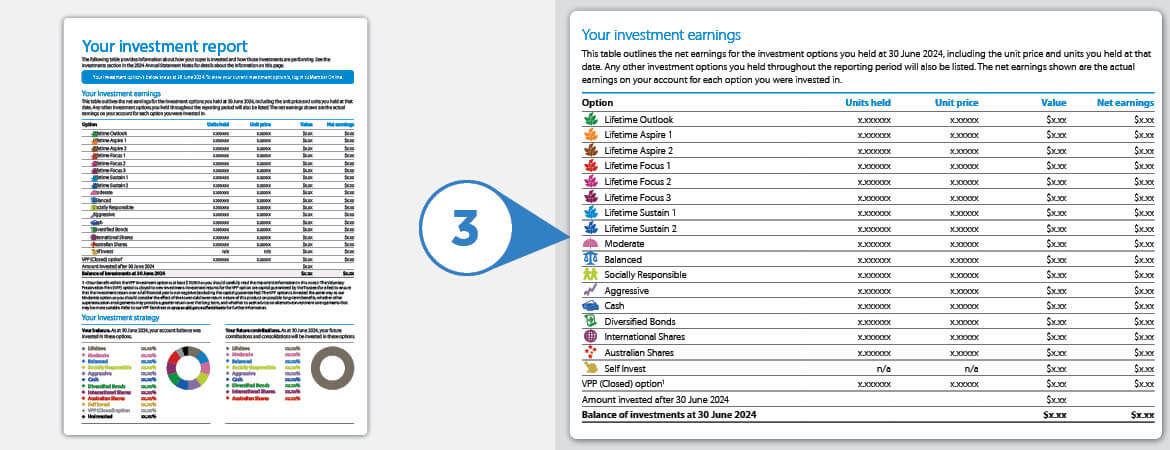

3

Check the performance of your investments

The investment report section of your annual statement shows how your money is invested and how those investments performed – including your net earnings as a dollar figure.

You can change your investment choice at any time by logging in to Member Online.

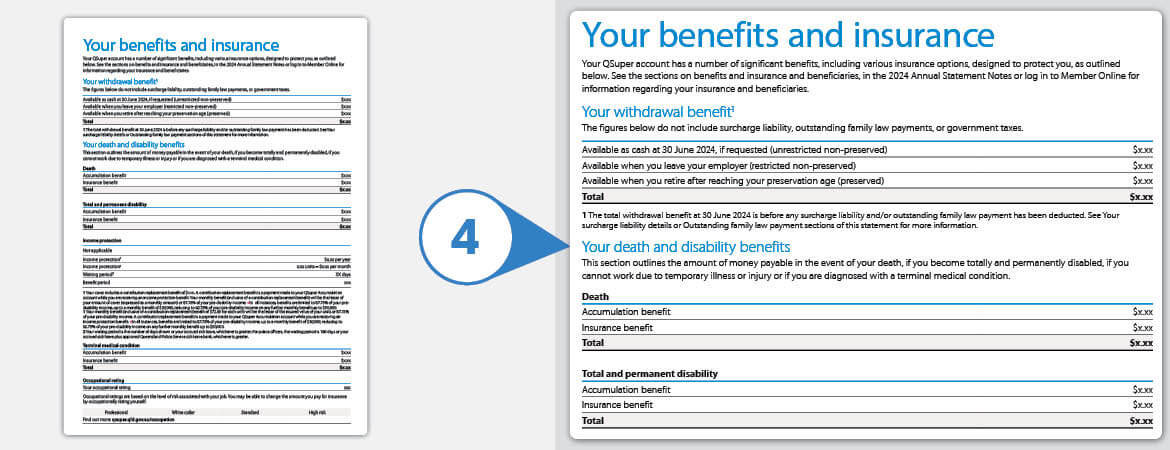

4

Check that you and your family are protected

We offer eligible members default insurance, with the flexibility to personalise your cover according to your personal circumstances. For more information about insurance cover, please visit our Insurance page.

Your annual statement will provide a summary of the insurance attached to your QSuper account as at 30 June, including whether you’re covered if you’re off work due to sickness or injury, and the amount that will be paid out if you die, become totally and permanently disabled or are diagnosed with a terminal medical condition.

We also display a member’s occupational rating and Income Protection benefit and waiting periods, if applicable.

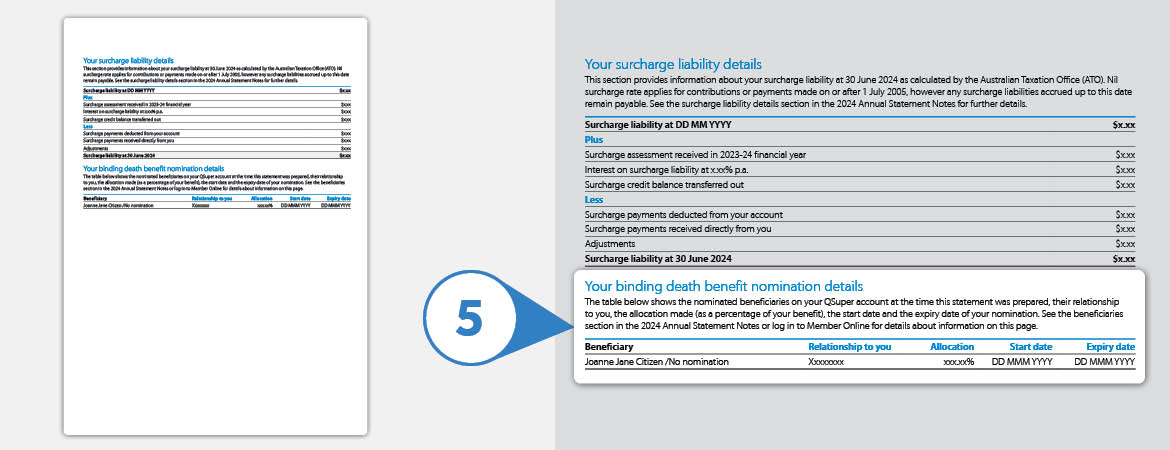

5

Check your beneficiaries

You can nominate a beneficiary to let us know who you would like to receive your super if the worst should happen.

If you’ve made a binding death benefit nomination, details will be shown after your transaction summary.

Your super doesn’t automatically form part of your estate so it’s important you make sure this information is up-to-date, especially if your circumstances have changed recently.

You can find out more about binding death benefit nominations, or renew your nomination at any time in Member Online under ‘Profile’ then ‘Beneficiaries’, or you can use this form.

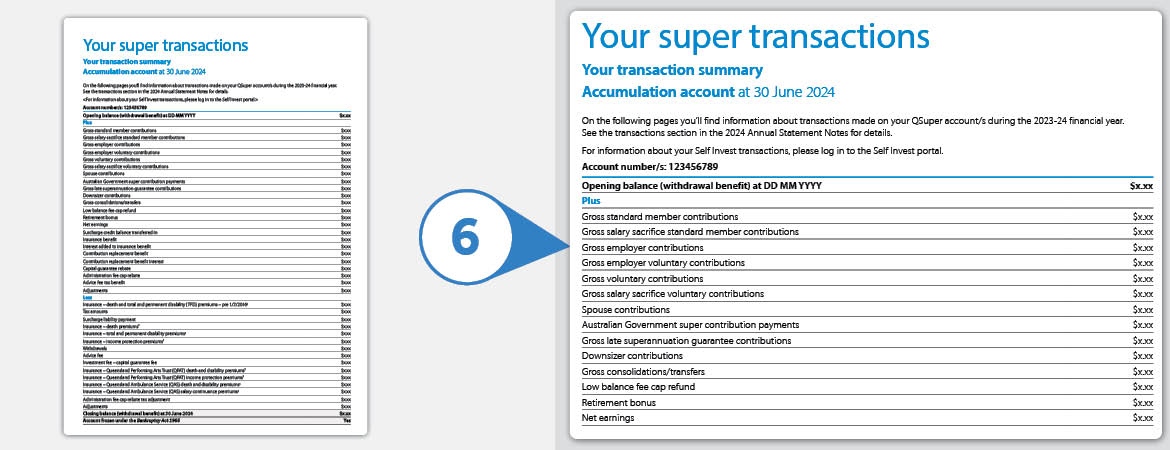

6

Review your transactions

Your statement also includes detailed information about the transactions made on your QSuper account during the year.

This includes how much you and your employer have contributed, fees and insurance premiums that have come out of your account, and any money you’ve rolled in from other super funds.

If you’re employed, check to make sure you’ve received regular contributions from your employer. If you’re topping up your super with salary sacrifice or voluntary contributions (after-tax), make sure they’re on there too.