How to personalise your insurance

02 March 2021

5

min read

Everyone's insurance needs are different, and some super funds may offer the option to tailor your cover to suit your needs.

Most super funds offer three main types of insurance, with more than 70% of Australians who have life insurance choosing to hold it through their super fund.1

The types of insurance available through super generally include life insurance, total and permanent disability (TPD) insurance, and income protection insurance.

As your life changes, so may the insurance cover you need, which means insurance does not need to be a set-and-forget option.

QSuper insurance is designed to be flexible. With QSuper, you can tailor your income protection insurance, total and permanent disability (TPD) cover, or death cover to suit you.

Tailor your insurance

How much cover you need will depend on your individual circumstances.

You can change your insurance to meet your personal needs, although it is important to note that tailoring your insurance may impact the premiums that you pay.

The cost of your insurance cover will depend on the type and amount of cover you hold, as well as your age and any ways in which you have personalised your cover.

Income protection insurance may help eligible members to maintain the lifestyle you've built for yourself and your loved ones by paying you a weekly benefit if you are unable to work due to serious illness or injury.

To personalise your income protection insurance, you may change:

- How much you're insured for (up to set limits)

While income protection products typically only protect 75% of your income, QSuper offers up to 87.75%, which includes a payment into your QSuper account.2 This means that if you're unable to work, you can still cover everyday living expenses and continue to grow your super.

- How long before you receive payments (your waiting period)3

If you make a claim and it is approved, your income protection payments will start as early as 90 days after the date you can't work because of illness or injury. If 90 days is too long and you don’t have enough sick leave or cash in the bank to meet expenses until your wait period is over, you might want to reduce your waiting period to 30 or 60 days. If you shorten your waiting period, you have to wait the length of your previous waiting period before your new waiting period applies to a claim.

- How long you'll be paid (your benefit period)3

If you get sick or injured, eligible members can receive payments for up to two years, giving you time to recover and focus on your health. This is known as a benefit period. You can change your benefit period to receive payments for up to five years or until you reach age 65.

- How much you pay based on your current job (occupational rating)

You may be paying more than you need to. If you're currently working in a role that's considered to be a lower risk, your occupational rating could mean you pay less for your insurance.

Members pay for insurance at our applicable default rates unless you review your cover and advise whether you fall into the standard, professional, white collar or high-risk rate.

Life insurance pays a benefit if you die or suffer from a terminal illness, while TPD cover pays a lump sum to you if you are unlikely to ever be able to work again after meeting the definition of total and permanent disablement.

To personalise your Life or TPD insurance, you may change:

- How much you're insured for (up to set limits)

Life and TPD cover comes in units of cover, with each unit worth a dollar value based on age. You can apply to buy additional units up to the maximum levels of cover of $3 million ($1 million if you are a casual employee or unemployed). There are some conditions around increasing your cover.

- How much you pay based on your current job (occupational rating)

You may be able to change the amount you pay for your insurance by occupationally rating yourself. If you personalise any of your cover, all your premiums will be payable at the relevant occupational rate.

- Whether your cover is 'fixed' so the dollar amount doesn't change unless you request it

Fixed cover is based on a fixed dollar amount nominated by you and will remain unchanged until you want to change it. You can switch between fixed cover and unitised cover at any time, although you must always switch both life insurance and TPD cover at the same time.

How to change your insurance

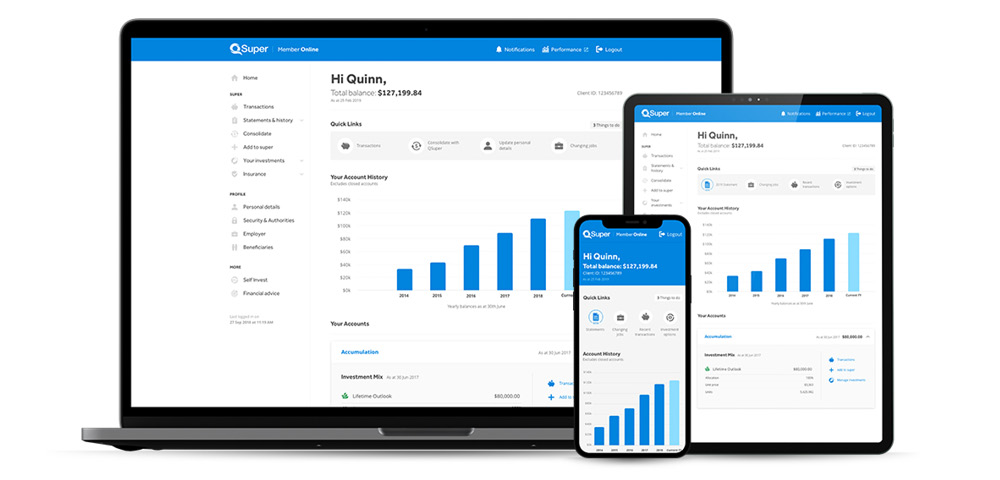

Tailoring your insurance with QSuper is quick and easy.

Simply log in to Member Online. Click on Change Your Insurance in the left-hand menu, then select an option to make changes to your insurance to suit your personal circumstances.

Alternatively you may access the appropriate Insurance forms on the QSuper website, to make the changes you require.

We’re here to help

You may also call QSuper at 1300 360 750

Monday to Friday from 8:00am-6:00pm.

1. Australian Securities and Investments Commission, MoneySmart: Insurance through super, accessed 19 January 2021 at https://moneysmart.gov.au/how-life-insurance-works/insurance-through-super

2. Cover amount is 87.75% of your insured salary which includes a contribution replacement benefit of 12.75% of insured salary into your QSuper account.

3.

Excluding Queensland Police Officers.