How QSuper is delivering key support for your business

04 December 2020

5

min read

QSuper is focused on making managing your super obligations easy so you can get on with running your business.

Now we are partnering with experts to provide you with even more trusted information that aims to support you and your workplace as it emerges from the impacts of the coronavirus pandemic.

With award-winning super products, dedicated support for your business, and streamlined processes, employers from across Australia choose to partner with QSuper.

We are partnering with industry experts to give you information to help attract, retain and engage with your best employees, so you can focus on your business needs.

We’re standing behind employers

While we will continue to provide you with all the super information you need, we will now also aim to provide you with the most up-to-date support and information you need when you need it.

In a year of unexpected challenges, you can feel confident that your super is in the safe hands of a fund that has been supporting employers and members for more than 100 years.

You can also feel assured that we have been working hard behind the scenes so that our usual support to you can continue as much as possible, along with a few extras.

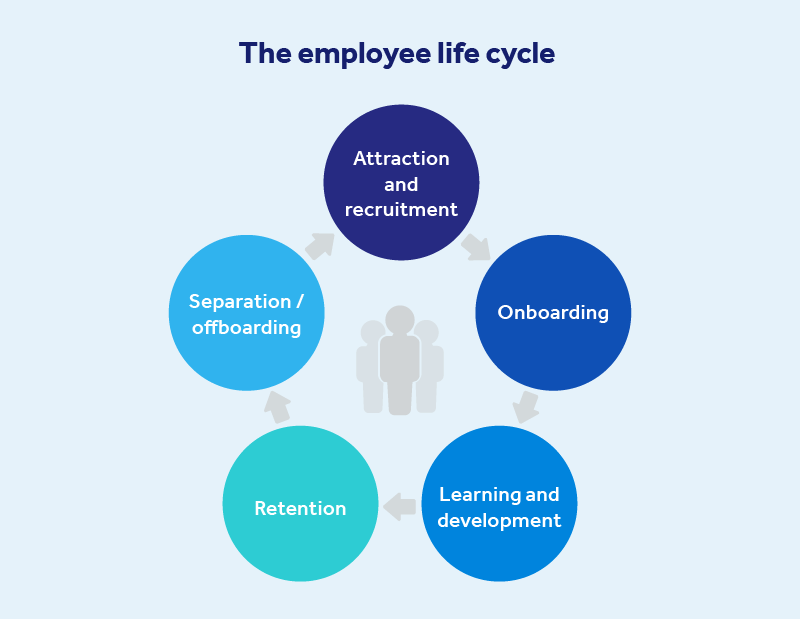

During the next few months QSuper will focus on providing trusted information that follows the employee life cycle so you can have confidence that your employees are on your business journey with you.

Supporting you throughout your employee’s life cycle

Using a framework that identifies various stages in which an employee advances through and interacts with your business, we will aim to provide you with the most recent and relevant information from experts to support your business and workplace.

By continuously developing and engaging with your employee, as an employer, you may help staff become better at their jobs, more satisfied working at your organisation, and more engaged with their careers.

Among topics we will cover are details about trends and technology in recruitment, onboarding, staff benefits and workforce planning.

Whether it’s an employee’s first day at work or after they have resigned to pursue other opportunities, positive engagement has significant value during every phase of your employee’s journey.

We’ll provide expert information on how employee engagement makes recruitment easier and more effective and how to retain, engage and boost productivity among your existing staff.

Your workplace culture may just be the difference that puts your business at the forefront of the evolving work environment.

Partner with a super fund that's right for you

It's easy to make QSuper your default super fund. With over a century of experience, tailored financial wellbeing solutions, and dedicated support for your business, it's easy to see why employers from across Australia choose QSuper as their default super fund.

More reasons to choose QSuper