Remote members score confidence and surprises with community visits

25 May 2020

6

min read

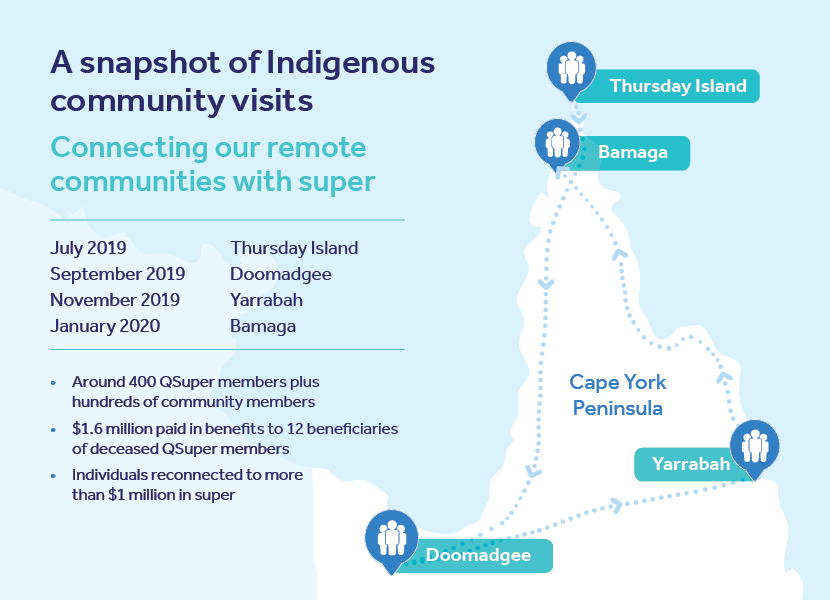

Trips to four Queensland Indigenous communities to help enhance members’ financial wellbeing saw remote QSuper members reconnect with more than $1 million in super.

The trips to Queensland Indigenous communities between July 2019 and January 2020 delivered stronger relationships with our remote members and reconnected many with their super.

The trips to Thursday Island, Doomadgee, Yarrabah and Bamaga, saw QSuper meet face-to-face with around 400 members as well as other community members.

The trips helped reconnect individual members with more than $1 million in super. Some members of those communities were also among 12 far north Queensland families who were paid more than $1.6 million as beneficiaries of deceased QSuper members.

Practical actions to enhance the financial wellbeing of Aboriginal and Torres Strait Islander peoples are among the priorities of QSuper’s Reconciliation Action Plan.

While members who attended the sessions benefited by connecting with their superannuation and were able to boost their confidence about their financial wellbeing, there were plenty of gains also for the QSuper staff members who made the trips.

Financial wellbeing in Bamaga

Our QSuper team travelled to Bamaga, about 40 kilometres from the northern tip of Cape York, in January 2020 as part of a regional community event to help members with their super and financial wellbeing.

The team aimed to help members understand their superannuation and provide support with binding death benefit nominations, death benefit claim forms and financial hardship claims forms. The team also assisted members to search for lost superannuation, consolidate their super¹, set up Member Online access and let eligible members know they may receive financial advice over the phone about investment options, contributions and insurance held with QSuper².

We had members approach us everywhere – under a mango tree, sitting in their cars, in the supermarket, at the airport both flying in and out. Even at the tip of Australia we were handed a member’s details as we were climbing the rock face." Ronda Lewis, Member Education Officer

Doomadgee connects with super

Doomadgee is an Aboriginal community of 1500 people, about 1000 kilometres west of Cairns and 130 kilometres east of the Northern Territory border.

During the two-day visit in September 2019, members of the QSuper Technical Advice team helped more than 86 community members and visited Doomadgee State School.

By working with people to help them understand their superannuation, the team assisted members with early release of super, insurance claims, finding lost super and consolidating super regardless of which super fund a person was a member of.

While we were there, we saw the challenges that the people in the community face every day. So, we did what we could and we helped anyone who asked us about their super, no matter which super fund they were a member of.” Graeme Marrinan, QSuper Technical Advice team

NAIDOC week on Thursday Island

As part of NAIDOC week in July 2019, QSuper visited Thursday Island to host a community hub event supported by the Australian Tax Office, the Indigenous Consumer Assistance Network, Registry of Births, Deaths and Marriages, Good Shepherd Microfinance and Good Shepherd No Interest Loans Scheme.

As word quickly spread, more than 200 people arrived for assistance with financial wellbeing.

The team helped a member find an unknown super account and assist another member who was in financial hardship discover a substantial Accumulation account balance. The team assisted by registering births, consolidating superannuation accounts, and explaining insurance.

There was a real sense of togetherness where everyone stopped and listened to what was truly important.” Mel Tyne, Corporate Social Responsibility team

Making a difference in Yarrabah

In November 2019, the QSuper team attended a 'Meet the Services' event in Yarrabah, about 50 kilometres outside Cairns, organised by the local Aboriginal Shire Council to provide a range of services to the community.

The team helped a steady flow of people throughout the day with issues including their super balances, consolidating accounts, and making extra super contributions.

Everyone there was super friendly and the main conversations I had were around, “what is super?” It was great to educate these members on how it works and when they can access funds.” Jessica Watts, Contact Centre team

1. Before you consolidate your super, you should check with your other super funds if there are any fees or tax implications, or loss of insurance or other benefits.

2. Advice fees may apply. Refer to the Financial Services Guide for more information.