QSuper: An industry leader in times of volatility

24 April 2020

5

min read

QSuper’s Balanced investment option has led the industry in investment performance over the past three months of extreme volatility and is an industry leader over 1, 3, 5 and 10 years. This is evidence of our unique investment strategy in action.

At QSuper, we take the responsibility of looking after our 585,000 members' financial futures very seriously.

The recent health crisis caused by coronavirus is having significant impact on share markets around the world, which has understandably caused concern for many QSuper members.

Despite this ongoing market volatility, our Balanced investment option has led the industry for investment performance for the three-month period ending 31 March 2020, according to research agency, SuperRatings.1

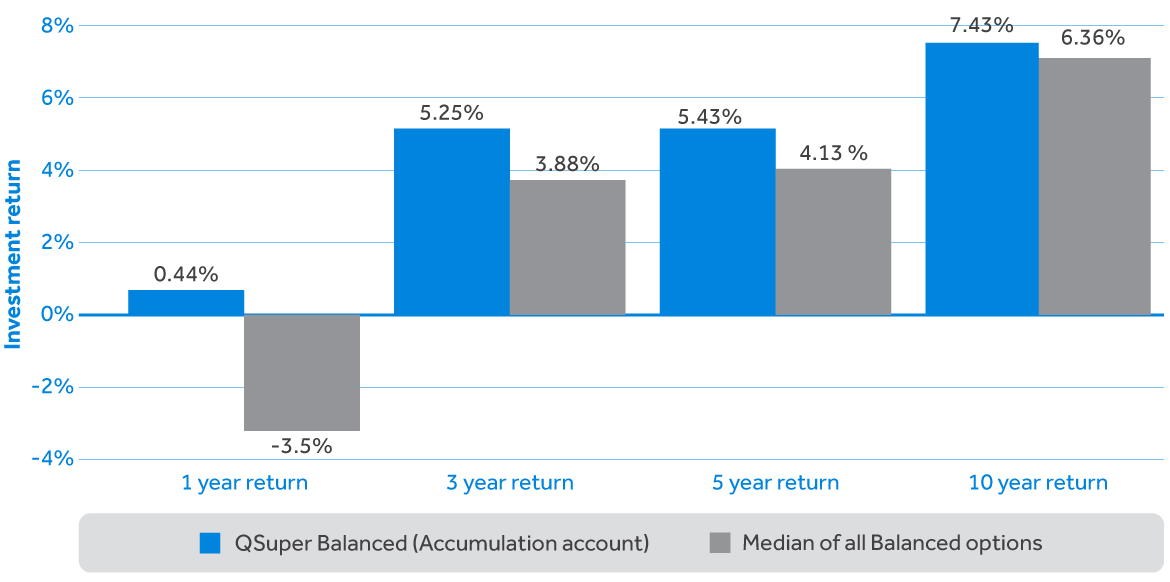

Our Balanced investment option is also an industry leader over the past year and decade, delivering a return over the past year of 0.44% and an average of 7.43% over the past 10 years to 31 March 2020.2

While many super funds have experienced negative returns recently, QSuper is one of only three super funds listed by SuperRatings1 to deliver a positive investment return for the Balanced investment option over the last 12 months to 31 March 2020 – making us a market leader in growing our members’ retirement savings.

Balanced investment option returns – as at 31 March 2020

Source: The table above shows the after fees and taxes return for QSuper’s Accumulation account Balanced option, excluding fixed administration, contribution and switching fees and insurance premiums. It also shows the after fees and taxes return for the SuperRatings SR50 Balanced (60-76) Index using median returns, excluding fixed administration, contribution and switching fees and insurance premiums. SuperRatings does not issue, sell, guarantee or underwrite this product.

QSuper Chief Investment Officer (CIO), Charles Woodhouse, said that QSuper’s position in the ratings table was evidence of the Fund’s unique investment strategy in action – one that aims to smooth the ups and downs of the market.

"I know that market volatility makes some of our members very anxious. The reality is that short-term low or even negative returns are an expected part of a long-term investment portfolio. Nevertheless, some QSuper members may be concerned about how their super balance has been impacted over the short term,” he said.

Your super is a big deal – but not a one-year deal – so where possible investors should consider the long term when looking at investment returns.”

Watch our market insights online broadcast to hear more from our CIO, Charles Woodhouse.

Our investment strategy in action

Our strategy aims to invest in a “risk-balanced” way. To put that another way, most other super funds seek asset diversity. Here at QSuper, we pursue risk diversity.

What that means for our members is decreased equity risk and increased exposure to other asset classes, led by bonds (which tend to go up and down at opposite times to shares), as well as direct infrastructure, real estate, private equity, and alternative investments.

This means that compared to most other super funds, less of our members’ money is invested in the share market, so our members’ superannuation account balances are more protected from the effects of sudden share market downturns.

Find out more about market volatility and how our investment strategy works.

1. SuperRatings Fund Crediting Rate Survey, March 2020. SR50 Balanced Index (60-76). Past performance may not be a reliable indicator of future performance. QSuper’s Accumulation account, Balanced option only, ranked first over three months, to 31 March 2020. SuperRatings does not issue, sell, guarantee, or underwrite this product. Ratings, awards or investment returns are only one factor that you should consider when deciding how to invest your super. Go to www.superratings.com.au for details of its ratings criteria.

2. SuperRatings Fund Crediting Rate Survey, March 2020. SR50 Balanced Index (60-76), QSuper Accumulation account Balanced option only, ranked third over one year and fourth over 10 years to 31 March 2020. Based on cumulative returns compounded annually after fees and taxes excluding fixed administration, contribution, switching fees and insurance premiums. SuperRatings does not issue, sell, guarantee or underwrite this product. For details on the methodology refer to superratings.com.au. Past performance may not be a reliable indicator of future performance.