Life expectancy is rising, but planning for it falls short

09 February 2018

6

min read

Senior Australians might know life expectancy is rising, but many have not planned for it. With increasing concerns about “under-saving” to support our longer lives, a new report shows there are plenty of reasons Australians aged 50 and over might like to think about accessing financial planning.

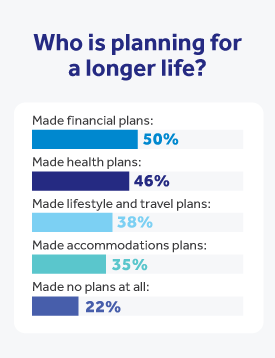

One in every two senior Australians haven’t made a financial plan that takes into account living longer, according to a new report by National Seniors.1

And almost one in four senior Australians “hadn’t planned at all” for an increasing lifespan, the report shows.

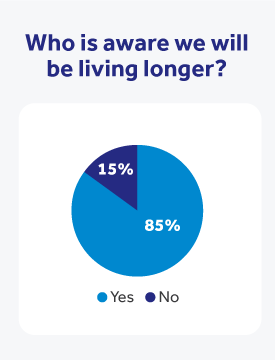

This is despite 85% of Australians over 50 being aware “life expectancy at 65 had increased by six years over the past 30 years.”2

The survey,3 called Hope for the best, plan for the worst? Insights into our planning for longer life, found many senior Australians who hadn’t planned felt it was “like homework” that they knew they should get to, but hadn’t done yet.

Some non-planners were philosophical or uncertain about planning due to health or advanced age. Others were just hoping, it found.

The report, released in February 2018, examined how senior Australians behaved and felt about making earnings from 40 to 50 years of paid work last 80 to 90 years of life.

The report noted that Australians were being asked to do something not previously required of their parents and grandparents, which was to save for a longer life than expected.

It examined whether people were aware of the trend for a longer life expectancy, and whether they were planning for it.

And if they weren’t planning, why not?

“The growing fear that Australians’ saving behaviour is not keeping pace with increasing life expectancy is also now a major issue around the world,”4 the report’s authors said.

The report found 50% of people 50 and over had made a financial plan to support their longer life and 46% had plans for their health.

It found 38% had plans for their lifestyle or travel, while 35% had plans for where they were going to live during this longer life expectancy.

Of the survey respondents, 22% hadn’t planned at all.

Source: McCallum, J., Maccora, J., & Rees, K. (2018). Hope for the best, plan for the worst? Insights into our planning for longer life. Brisbane, National Seniors.

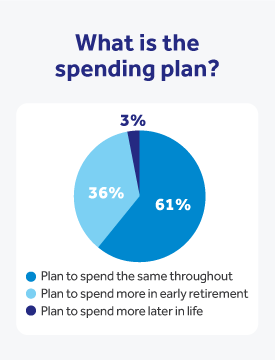

Significantly, the report found the plans most people had for spending their money “paid little or no attention” to later old age when there were likely to be significant costs. It said many Australians could run out of money before they got there.

“The two-thirds planning to spend the same throughout, are treating retirement income like a steady wage which may not cover the latest period of their lives.”4

However, the finding that more than half were planning on the same spending throughout their retirement, rather than spending their money early in retirement, was a “mild positive,” the report said.

Only 3% planned for spending more later in life, when needs were likely to be highest.

1 McCallum, J., Maccora, J., & Rees, K. (2018). Hope for the best, plan for the worst? Insights into our planning for longer life. Brisbane: National Seniors.

2 National Seniors and Challenger (2017) Seniors More Savvy about Retirement Income. Brisbane: National Seniors. (19 pages) published 3/10/17

3 An online survey of 5,511 respondents of 53,058 National Seniors Australia members aged 50 and over residing in all Australian states and territories, conducted as part of the 2017 National Seniors Social Survey, with the assistance of Challenger, 24 May – 11 June 2017.

4 The views of the author are not necessarily those of the QSuper Board.

5 Advice fees may apply. Refer to the Financial Services Guide for more details.