How can I use my super to buy my first home?

The First Home Super Saver (FHSS) Scheme allows first home buyers to make contributions to their super, then withdraw those contributions for a deposit to buy or build a home to live in.

The scheme aims to make it easier to buy or build your first home, but there are rules around who can use the FHSS and when you can get your money out.

If you're unable to buy a home in the 12-month period, you can refund the money back into your super account to take out at a later date.

How much can you put towards your deposit?

A single person could make super contributions of up to $15,000 per year, up to a total of $50,000.

If the people you are buying a home with are also eligible for the scheme, they can make contributions of up to $15,000 per year to their super, up to a total of $50,000 per person. This means a couple could potentially put a total of $100,000 towards their deposit from their super.

Be mindful that there are limits to how much you can contribute to your super each year, and if you go above these limits, you may pay extra tax.

Find out more about the potential benefits of using super to buy a home.

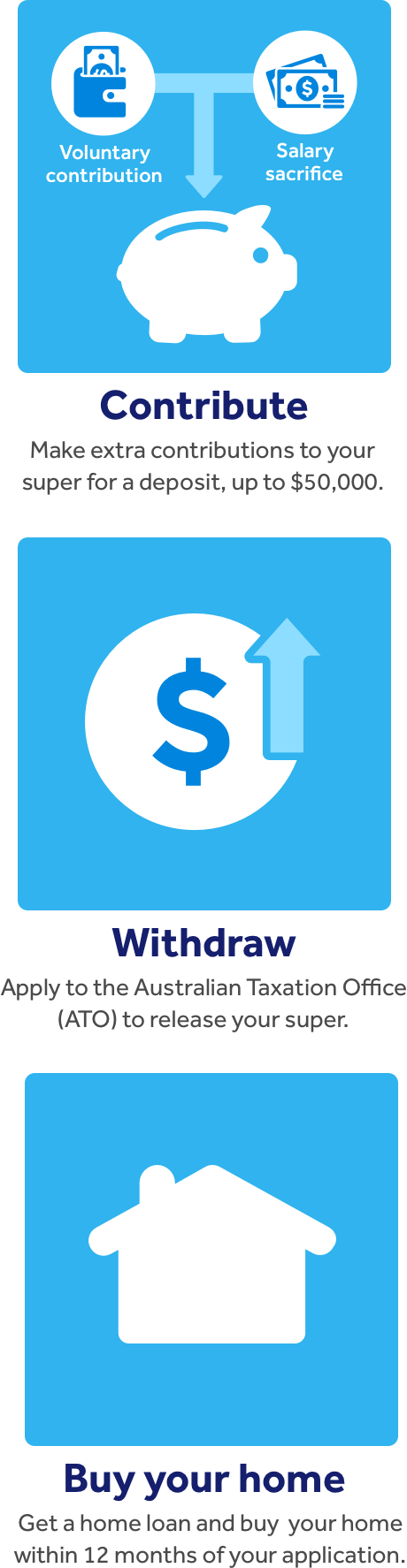

How to use the FHSS Scheme

If you are eligible and want to withdraw money from your super for a home deposit, here's what you need to do.

- Make salary sacrifice or voluntary contributions to your super account

- Use your myGov account to apply to the Australian Taxation Office (ATO) for a FHSS determination

- When you receive your determination, apply to the ATO to release your super

- The ATO will tell your super fund to release your super contributions

- Your super fund will send the ATO your money

- The ATO will withdraw tax, then pay you the remaining amount

- You get a home loan and buy or build a home within 12 months from the date you made your release request

- You notify the ATO within 28 days of entering into contract.

The ATO says it can take as many as 15-25 days to receive your money from them, so it's important you are not in a hurry to put down the deposit.

If you don't buy a home within 12 months of receiving your money, you can choose to refund it back into your super account. Otherwise, you could pay up to 20% tax!

You can then reapply to access your super money at a later date. There's no restriction on the number of times you can reapply for the scheme as long as you've got the money available and meet the eligibility criteria.

Am I eligible?

To qualify for this first home super scheme, you must:

- Be aged 18 years or older

- Have not previously owned property or vacant land in Australia (including investment properties)

- Have not already bought a house using this scheme

- Currently be house hunting or looking to buy or build a property within the next 12 months

- Planning to live there for at least 6 of the first 12 months you own it.

You must buy a property (or enter into a contract for construction of a property on vacant land) in Australia, not a mobile home (e.g. caravan, RV motorhome, houseboat, tiny house).

Get advice

A financial adviser can help you understand how to use the First Home Super Saver Scheme in your personal circumstances and how to get the most from your super.

Find out more

How to make first home super saver contributions

There are two types of contributions you can put towards your home deposit with the super saver scheme:

- Salary sacrifice contributions

- Voluntary contributions from your take-home pay.

Talk to your payroll office to start salary sacrificing, or use your BPAY® details in Member Online to make after-tax voluntary contributions.

The super contributions you put in the FHSS scheme will also increase by an interest rate set by the Government. These 'deemed investment earnings' are meant to represent investment returns on your contributions.

How much you can withdraw

The type of contributions you make will affect how much money you can withdraw from your account. You can withdraw up to:

- 85% of eligible before-tax contributions

- 100% of eligible after-tax contributions

- 100% of the deemed earnings.

You can't include the contributions your employer or spouse makes for you, such as Superannuation Guarantee (SG) contributions or spouse contributions.

What else to consider

While contributing to your super might help you save money for a house deposit, it may not be right for everyone.

- Withdrawing super for a home deposit may impact your retirement savings in your super account.

- Your employer's super contributions and spouse contributions can't be used for your deposit, so the scheme requires that you can save enough money to make extra contributions.

- Depending on whether you make before-tax or after-tax contributions, you might not be allowed to withdraw the full amount to use for your deposit.

- Your contributions earn a deemed rate of interest set by the Government, rather than earning the full investment returns your super fund is making.

- When the ATO sends you your super saver money, they charge tax on your before-tax contributions and deemed earnings.

- You will need to include the FHSS amounts you receive from the ATO as income when you fill in your yearly tax return.

Whether or not you are eligible for the first home scheme, your super is likely to be one of your main sources of income in retirement, so it's worth considering whether you could afford to make regular contributions to your super anyway.

To learn more the FHSS scheme, visit the ATO website.

Are there fees to use the super saver scheme?

Show content

We do not charge any additional fees for you to participate in the First Home Super Saver Scheme.

However, remember that you pay tax on salary sacrifice contributions, and that the ATO taxes your money again before they send it to you, so the amount you receive from the scheme is not the same amount you contributed to your super. This is due to the difference between the rates for contributions tax and income tax.

How is super saver money taxed?

Show content

Your contributions to your super for your home deposit get taxed differently depending on how you make the contribution:

- Salary sacrifice contributions (before-tax) get taxed at 15% when you contribute them to your super account.

- Voluntary contributions from your take-home pay (after-tax) have already been taxed, so they don't get taxed again when you contribute them to super.

When the ATO sends you your super saver money, they charge tax on your before-tax contributions and deemed earnings at your marginal tax rate, less a 30% offset. (If the ATO can't estimate your expected marginal tax rate, they charge tax of 17% instead.)

No extra tax is charged on your after-tax contributions.

The ATO will send you a payment summary showing how much tax you paid. You need to include this amount, and the amount you received from them, in your annual tax return for the year you request your money.

I have a HECS/HELP student loan debt. Will this be taken out of my first home super saver amount?

Show content

No. Although the ATO would deduct money from your first home super saver amount if you had any "outstanding Commonwealth debts", this doesn't include higher education or trade support loans (e.g. HECS, HELP, SFSS, TSL).

Commonwealth debts that would be deducted include if you have not paid enough for your income tax, business tax, child support, or Centrelink debts.

What if I don't end up buying a home?

Show content

Under the FHSS scheme, if you don't end up buying a home within the 12-month timeframe, you must re-contribute your before-tax contributions back into your super account. You can then reapply to access them under the FHSS scheme at a later date. There's no restriction on the number of times you can apply to do this as long as you've got the money available and meet the eligibility criteria.

If you decide to keep the before-tax contributions, the ATO will charge a FHSS scheme tax. This is equal to 20% of your assessable amounts released under the first home saver scheme.

You do not have to re-contribute your after-tax contributions to your super - but you might want to put them back into super to continue boosting your retirement savings.

Can I use the FHSS scheme if I buy with someone who is not eligible?

Show content

If you are eligible and you want to buy a home with someone else, you can apply to access your super contributions even if the other person is not eligible for the scheme.

® Registered to BPAY Pty Ltd ABN 69 079 137 518