Reading your Income account statement

03 July 2023

5

min read

Here are 6 things to check when you receive your 2023 Income account annual statement.

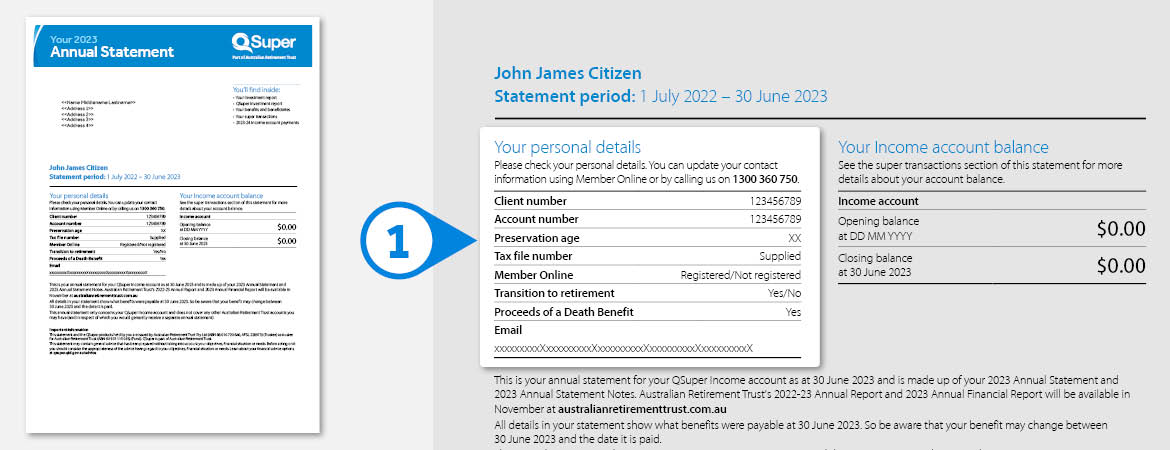

1

Check your personal details

The personal details section on your statement contains the following:

- Your client number, which is unique to you

- Your account number, which is unique to your account

- Your tax file number (TFN). Make sure we have this on file. If we do, it will say “supplied”.

- Your preservation age, which is the age you can access your super.

Check whether you’ve registered for Member Online. It’s the easiest way to keep up-to-date with your investment performance, income payments and account balance.

Finally, check your email address and postal address. You can make any changes quickly and easily in Member Online.

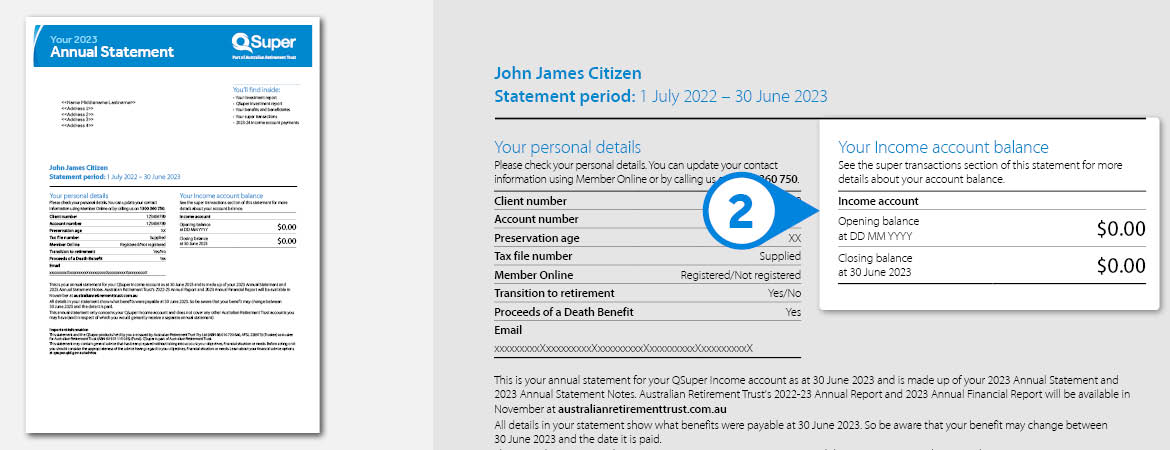

2

Check your account balance

Your annual statement will also show your opening balance at the beginning of the financial year (or the date your account was opened), compared with your closing balance at the end of the financial year, (where applicable).

3

Check the performance of your investments

The investment report section of your annual statement shows how your money is invested and how those investments performed – including your net earnings as a dollar figure.

We have also included your payment preference, which shows the investment options that your income account payments will come from, and in which proportion or order they will be drawn.

You can change your investment choice at any time by logging in to Member Online or by downloading a Switch Investments in an Income account form.

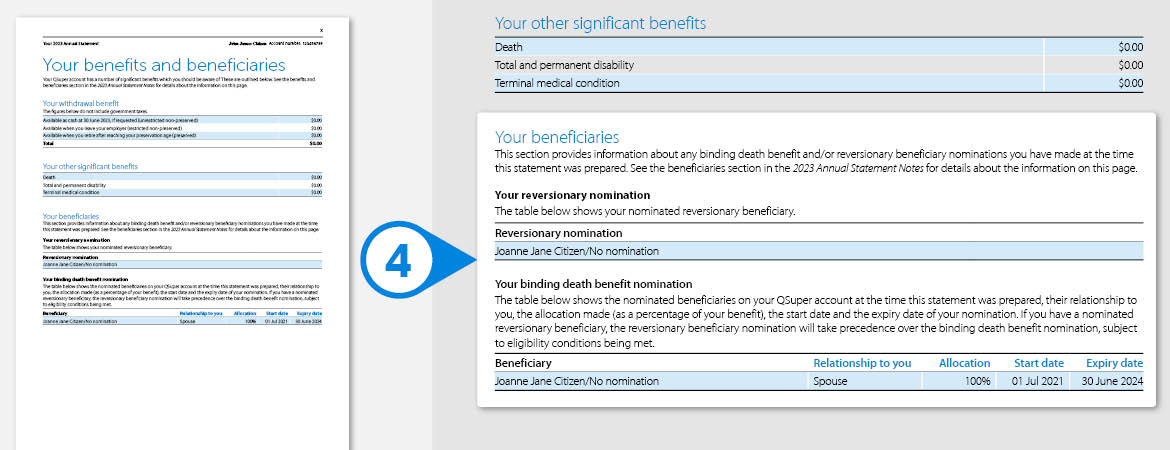

4

Check your beneficiaries

A beneficiary is a person who you have nominated to receive your super money if you die.

If you’ve made a binding death benefit nomination, or reversionary nomination, details will be shown in the benefits and beneficiaries section of your statement.

Your super doesn’t form part of your estate so it’s important you make sure this information is up-to-date, especially if your circumstances have changed recently.

You can find out more about binding death benefit nominations, reversionary nominations, or renew your nomination at any time in Member Online.

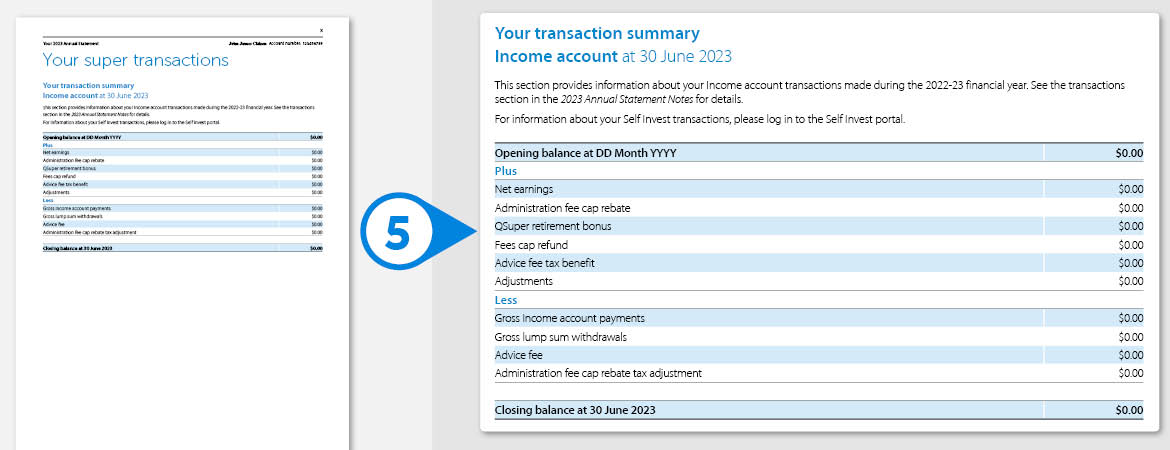

5

Review your transactions

Your annual statement includes detailed information about the transactions made on your Income account during the year.

This includes net earnings applied to your account, and any fees, taxes, income account payments and withdrawals that have come out of your account.

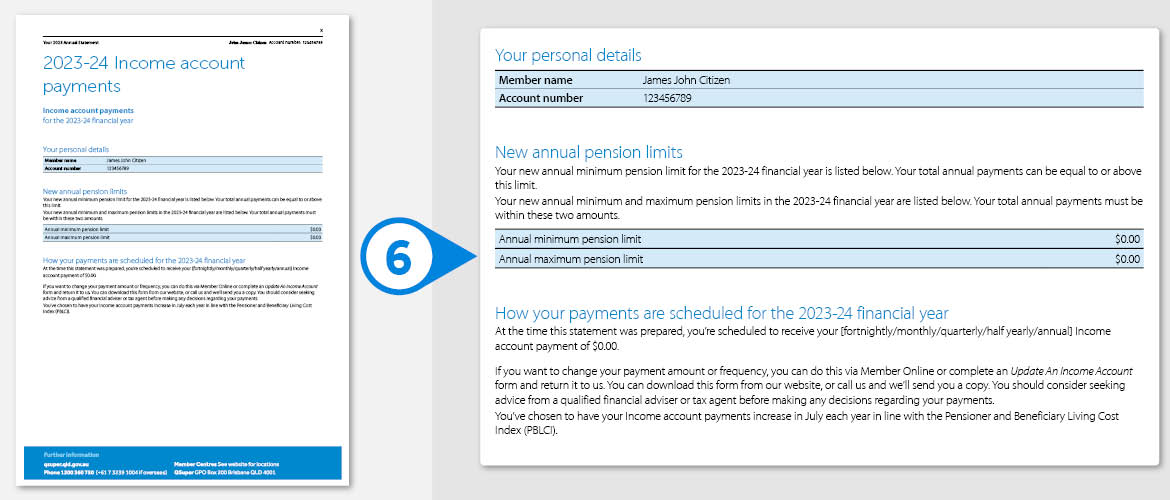

6

Plan for your 2023-24 Income account payments

The final part of your statement to read through details your income account payments for the 2023-24 financial year, including how much and how often money will be deposited into your bank account.

Your statement will also show the minimum payment amount that you are required receive in the financial year and, if you have a Transition to Retirement Income account, the maximum amount you can receive.

If you want to change your payment amount or frequency, simply log into Member Online or complete an Update an Income account form and return it to us.