Reading your Defined Benefit account statement

03 July 2023

5

min read

With a Defined Benefit account, feel good about your super today, knowing you'll receive a defined benefit later. Here are 7 things to check when you receive your 2023 Defined Benefit annual statement.

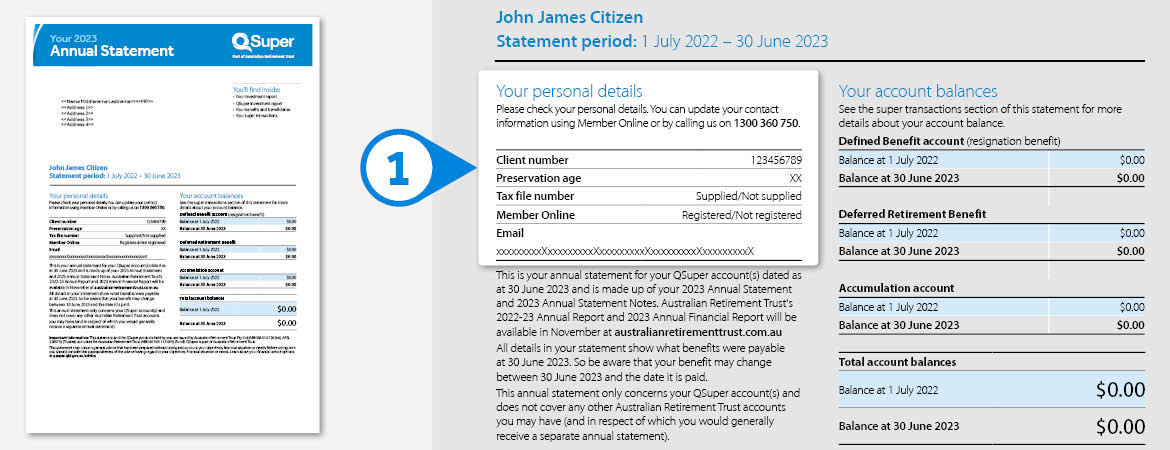

1

Check your personal details

The personal details section on your statement contains the following:

- Your client number, which is unique to you – like an account number

- Your tax file number (TFN). Make sure we have this on file. If we do, it will say “supplied”.

Check whether you’re registered for Member Online. It’s the easiest way to keep up-to-date with your investment performance, contributions, and account balance.

Finally, check your email address and postal address. You can make any changes quickly and easily in Member Online.

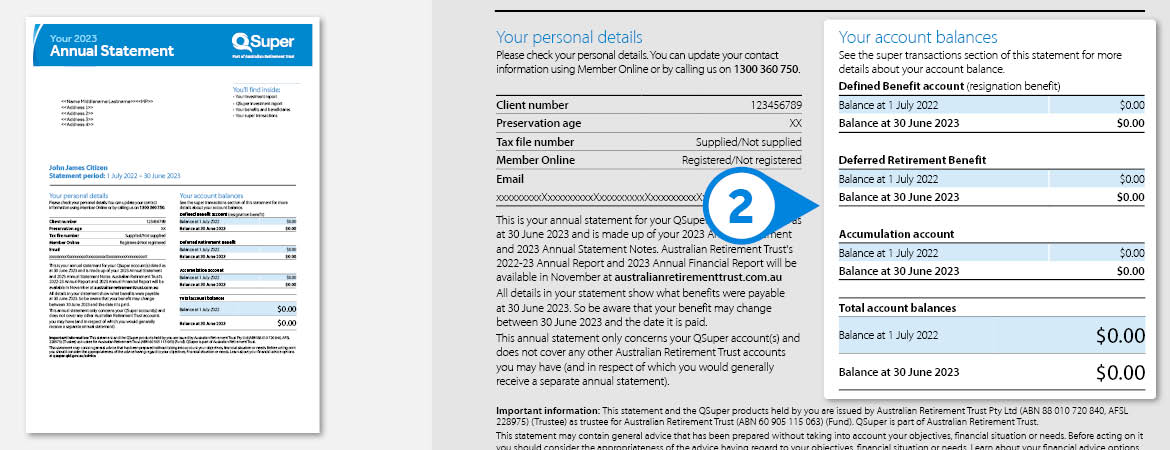

2

Check your account balance

Your annual statement will also show your opening balance at the beginning of the financial year, compared with your closing balance at the end of the financial year.

Depending on your circumstances, this could include a Defined Benefit account balance, a Deferred Retirement Benefit account balance, an Accumulation account balance, or a combination of these. Take note of your total account balance – it is tallied at the bottom of the table.

To see the latest estimate of how much you’ll get, or a projection of how much you may get when you retire, you can log in to Member Online at any time.

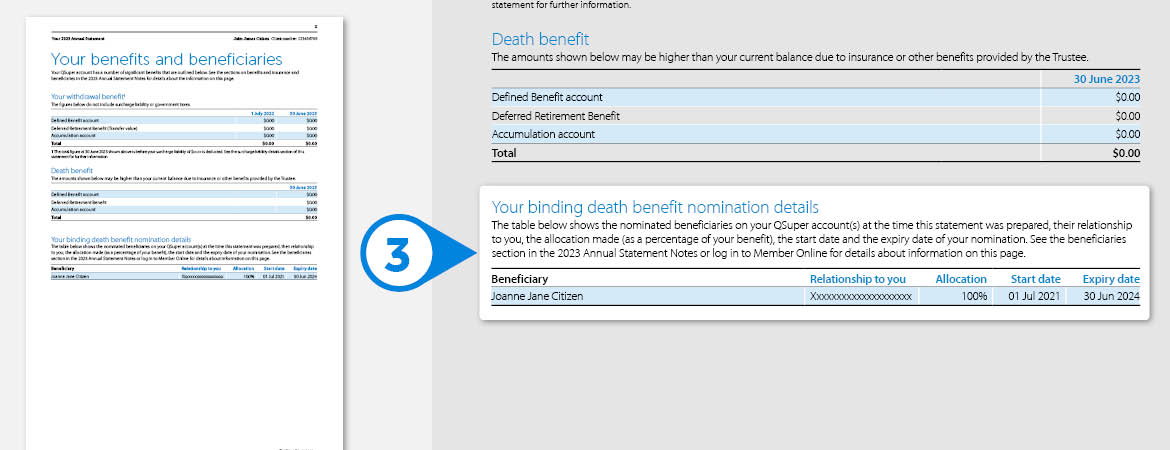

3

Check your beneficiaries

You can nominate a beneficiary to let us know who you would like to receive your super of the worst should happen.

If you’ve made a binding death benefit nomination, details will be shown in the ‘Your benefits and beneficiaries’ section.

You can find out more about binding death benefit nominations, or renew your nomination at any time in Member Online under ‘Profile’ then ‘Beneficiaries’, or you can use this form.

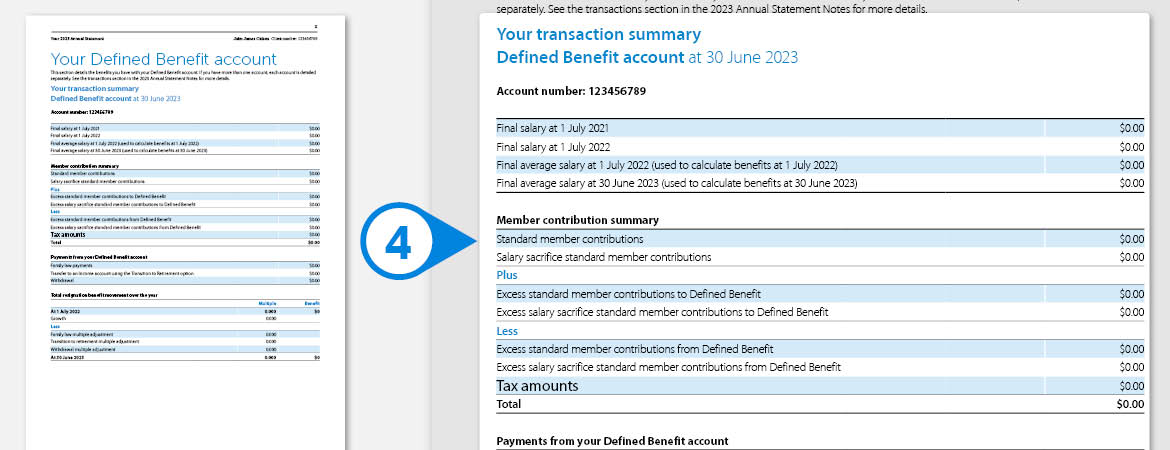

4

Review your transactions

With a Defined Benefit account, your retirement benefit is calculated by multiplying a number that reflects both your years of service and your contribution rate (your multiple) with your final salary.

Your annual statement includes these details, as well as other information used to calculate your benefit, like your standard member contributions and contributions your employer has made on your behalf.

We have also included how your total resignation benefit has changed over the year, so you can see how your super is tracking.

If you have been adding more to your super by making voluntary contributions on top of the standard contributions, check that this is reflected in your Accumulation account transaction summary.

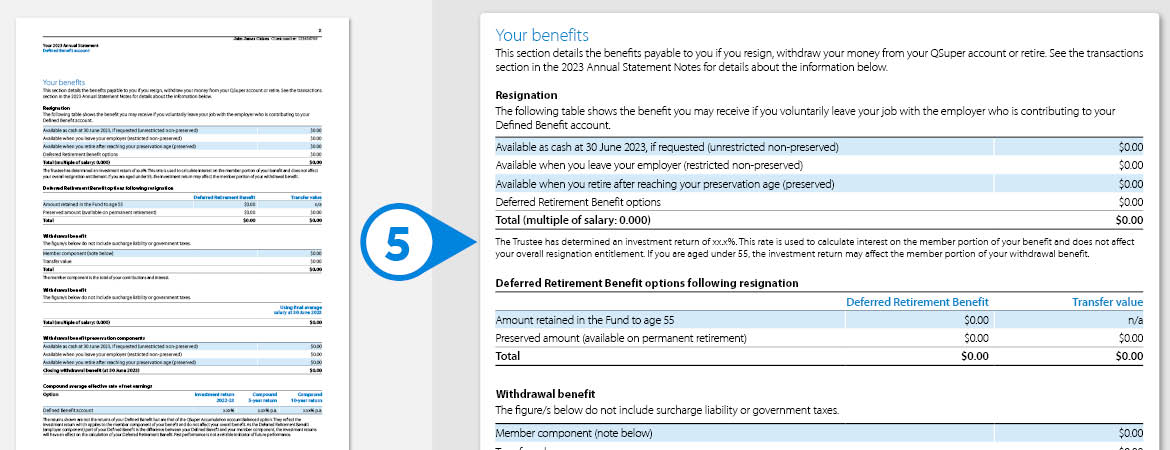

5

Check that you and your family are protected

Your annual statement will detail the amounts payable to you if you resign, withdraw your money, or retire.

It will also show whether you are covered if you are off work due to sickness or injury, and the amount payable if you’re retrenched, die or become permanently disabled.

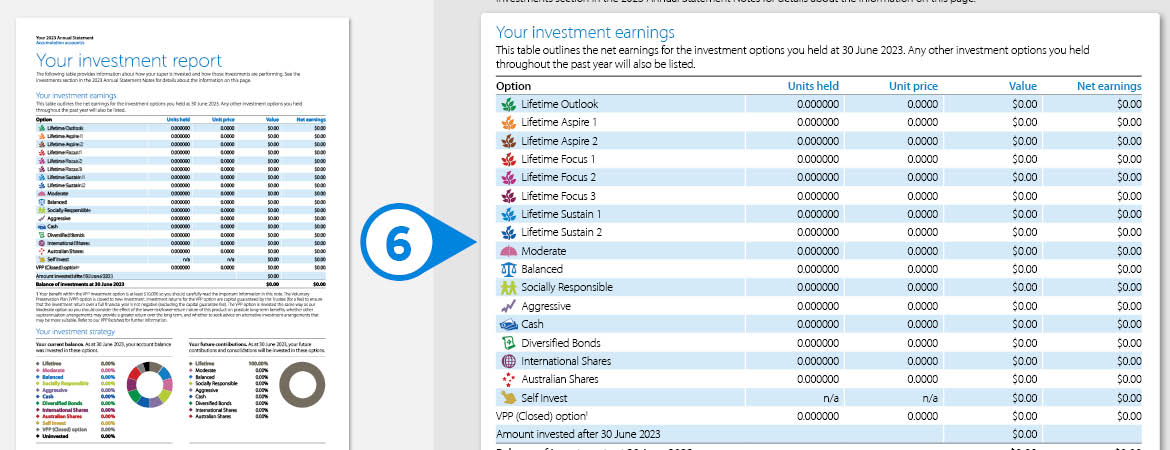

6

Check the performance of your investments

As a Defined Benefit account member, your entitlement is not impacted by market movements and you will get a defined benefit when you retire.

If you also have an Accumulation account, your annual statement will also show how your Accumulation account balance is invested and how those investment options performed.

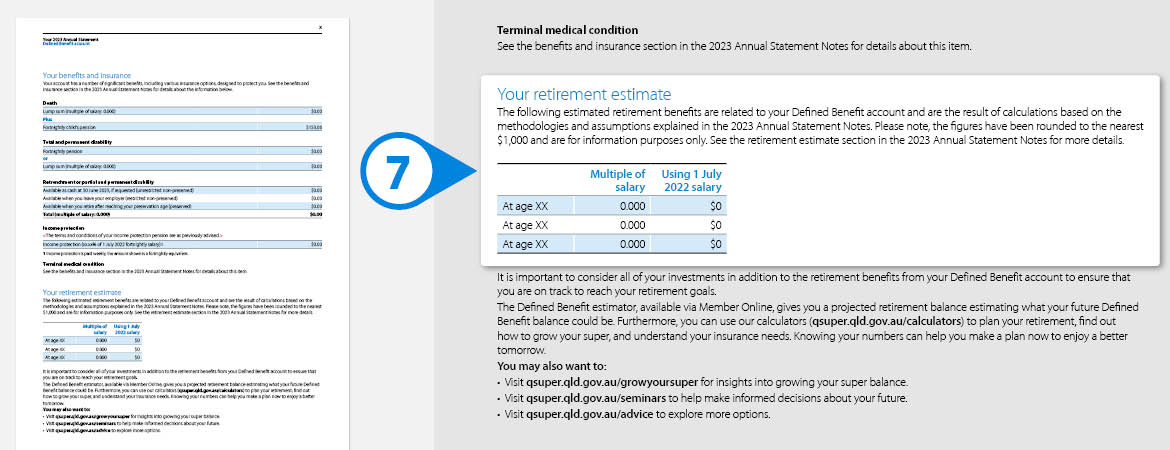

7

Check your retirement estimate

We have also included a retirement estimate which details the amount you could receive if you are eligible to retire at each of the ages listed.