Make your defined benefit reach its full potential

05 October 2020

5

min read

As a Defined Benefit account holder, you can feel good about your super today knowing you’ll receive a defined amount when you stop working. However, by making small changes today, you could still make a difference to how much you will have when you retire.

As a Defined Benefit account holder, there are small changes you can make today that could make a difference to how much you will have when you retire.

For example, if you are contributing less than the ‘default rate’ (this is 5% of your salary for super purposes for most members, 6% for police officers), you may be able to ‘catch up’ by making up for contributions you didn’t pay earlier.

Example1 of the difference it could make

Joe’s story

Joe’s story

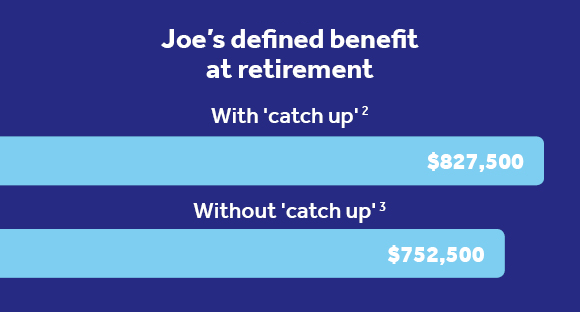

Joe is a QSuper Defined Benefit account holder. After starting a family 20 years ago, Joe’s priorities changed, he reduced his defined benefit contribution rate from 5% to 4%. This increased Joe’s take home pay, but reduced the amount going towards his retirement savings.

Now aged 50, Joe has started to think more broadly about his financial situation. He meets with a financial adviser to review the setup of his Defined Benefit account.

Joe found that his contribution rate with QSuper was still set at 4%, meaning his defined benefit may not reach its full potential.

To address this, Joe decides to ’catch up’ on the time he was only contributing 4% by temporarily increasing his contribution rate to 6%.

By ‘catching up’, Joe will end up with a higher amount, giving him more money when he stops working.

'Catch up' to get the full benefit

Call us to see if you have 'catch up' contributions to make. 1300 360 750

1. The member depicted is not real and the case studies are provided for illustrative purposes only.

2. Assuming Joe’s final average salary is $100,000 and he contributed for a total of 40 years – five years at a 5% contribution rate, 20 years at a 4% contribution rate and 15 years at a 6% contribution rate. Please note that ‘catch up’ is capped at 3% above a member’s default rate.

3. Assuming Joe’s final average salary is $100,000 and he contributed for a total of 40 years – five years at a 5% contribution rate and 35 years at a 4% contribution rate.