Super is better together

19 March 2019

5

min read

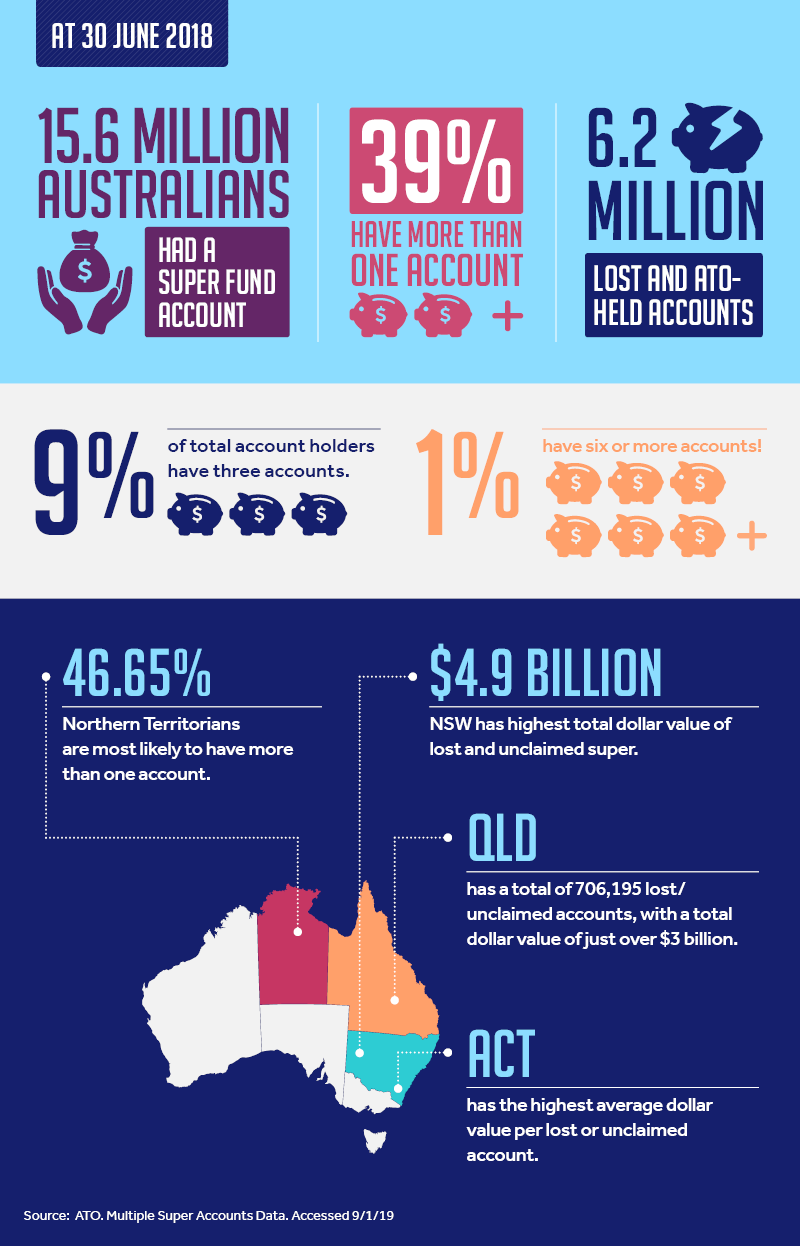

The ATO tells us that at 30 June 2018, over 15.6 million Australians had a super fund account, and of these people, 39% had more than one account.¹

This may be a strategic decision for some, but for others it may be the result of a forgotten or misplaced account from previous employment, in which case locating this money is a good idea.

With research showing that one in three Australians worry about their finances in work hours,² having your employees set aside five minutes to consolidate their super makes great business sense.

Why consolidate?

Pay fewer fees

One super account could mean fewer fees, which could mean more in your retirement savings.

Keep track of your super and reduce paperwork

One super account means one statement, making super easier to manage.

Avoid excess insurance premiums

One super account reduces your chance of paying multiple insurance premiums. More money in premiums can mean less money in retirement.³

All it takes is five minutes

By consolidating their super into one account, your employees can feel better knowing their super is all together in a top-performing super fund.⁴

| Consolidate in minutes |

|

1. Log-in or register for Member Online. To register you’ll need your Client ID.

|

2. Select Consolidate with QSuper from the

Quick links list on the right, provide your

details and we’ll consolidate your accounts.

|

1 ATO. Multiple Super Accounts Data. https://www.ato.gov.au/about-ato/research-and-statistics/in-detail/super-statistics/super-accounts-data/multiple-super-accounts-data/ accessed 11 February 2019.

2 Source: The Financial Fitness of Working Australians, Map My Plan, November 2016.

3 Before you consolidate your super, you should check with your other super funds about any exit fees or loss of insurance or other benefits.

4 QSuper’s Balanced investment option has been ranked #1 for performance over 10 years by SuperRatings. SuperRatings SR50 Balanced Index (60-76) median based on cumulative returns compounded annually after fees and for initial $50,000 invested over the period ten years to 31 December 2018. Past performance is not a reliable indicator of future performance.

This information is provided by QInvest Limited (ABN 35 063 511 580, AFSL 238274) on behalf of the QSuper Board (ABN 32 125 059 006, AFSL 489650) as trustee for QSuper (ABN 60 905 115 063). It has been prepared for general purposes only, without taking into account your personal objectives, financial situation, or needs. All QSuper products are issued by the QSuper Board as trustee for QSuper. Consider whether the product is right for you by reading the product disclosure statement (PDS) available from our website or by calling us on 1300 360 750.

© QSuper Board 2019. DTEC-938. 02/19.