How women can plan to win financially.

Money matters

6 April 2018 |  8 min read

8 min read

Despite progress in the workplace and the home, women may still face greater financial risks than men, including having much lower retirement security than men. But taking control of personal finances and pursuing greater financial independence may help women feel more confident to enjoy financial wellbeing today as well as in retirement.

There are a number of factors that may contribute to women facing greater financial risks and having lower retirement security than men.

On average, women in Australia earn 15.3% less than men in full-time jobs. That amounts to $251.20 per week less, according to the Workplace Gender Equality Agency.1

The Agency’s gender equality scorecard, based on 2016-17 data, shows there are a number of issues that may contribute to this gap:

- discrimination and bias in hiring and pay decisions

- women and men working in different industries and jobs, with female-dominated industries and jobs attracting lower wages

- women’s disproportionate share of unpaid caring and domestic work

- lack of workplace flexibility to accommodate caring and other responsibilities, especially in senior roles

- women’s greater time out of the workforce, limiting career progression and opportunities.

The super gap

The super gap

Disparity in pay may be just one issue that contributes to women reaching retirement age with less in their superannuation than men.

The Workplace Gender Equality Agency says its data2 shows that the gender pay gap in average annual earnings for full-time permanent employees, results in an annual 19.3% shortfall in superannuation contributions for women compared to men.

In line with national trends, QSuper figures based on analysis of member data in May 2017, shows individual women, on average, retire with around a third less superannuation than men.

In Brisbane, for example, the figures showed the retirement gender gap in 2017 was 33%, with men retiring on an average balance of $388,000 while women had an average $263,000.

The lack of adequate super and funding for life after paid work, can cause significant problems for many women. The combination of rising home prices, insufficient super funds, and loss of relationships has contributed to a doubling of the number of older women in Australia couch surfing or sleeping in cars, Homelessness Australia said.3

Financial wellbeing at every stage

Financial wellbeing at every stage

At every stage of life, taking more control of your money can help you towards greater financial independence. It can also help ensure you have a plan that will prepare you for life after paid work.

Steps towards financial independence for women at any life stage may include controlling your cash flow, determining your goals, paying off debt, saving for retirement, and protecting what’s important.

You may be commencing a relationship and considering whether to open joint accounts, or looking for tips on discussing money as a couple.

As a woman, you may have been planning to work your entire life, only to find that once you find yourself preparing for a baby, you may be considering working part time or not at all.

If your day involves running around after your children, looking after your parents, and trying to squeeze in work you may find yourself part of the increasing number of women who make up the “sandwich generation."4 It may be important to you to discover some survival tactics to get you through this stage financially.

Life events

Start your plan

Start your plan

It’s never too early to have a plan to take control of your finances.

Accessing financial advice tailored to your needs can be a good place to start.

You can also consider these steps women can take now to specifically address some of the super gender gap:

- Get to know your super fund. Track down any lost or unclaimed super and consider whether it is right for you to consolidate your super accounts.

- Consider making additional contributions – find out how paying yourself forward can help you feel more confident about your finances today.

- Consider whether spouse contributions5 are another way to boost your superannuation balance.

In practice: what Ruby did

In practice: what Ruby did

Meet Ruby,6 aged 35.

Ruby had a goal of home ownership and chose to invest in property on her own so she would have the house paid off by the time she retires.

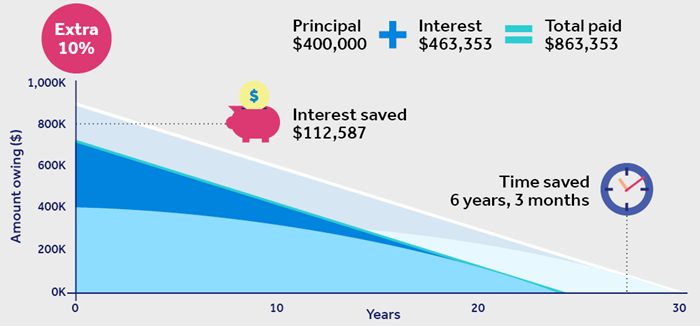

Ruby took out a 30-year loan. She borrowed $400,000, with the interest rate at 6%. (Note: This is higher than current rates but below the average over the past 10 years, which is about 7%.7

At 6%, her interest charges are $463,000 — more than the cost of the house itself. To put that a different way, for every $1.00 she puts towards paying off her house, she has to pay $1.16 in interest to the bank.

Ruby learned that by adding just 10% more to her repayments, about $240 per month, she could save $112,587 and pays off her loan six years and three months earlier.

If she increased repayments by 20%, she could save $178,000 and knock a decade off the time it would take to repay her loan.

Ruby chose to prioritise her mortgage under the commitments and essentials element of her financial plan. Ruby also chose to increase her repayments by 20% above the minimum rate on her home loan.

Sign up for future She’s on Q updates

With the right information you can make informed decisions about your career, financial security and life goals.

Sign up

1. Australian Government Workplace Gender Equality Agency, 2017, ‘Australia’s gender pay gap statistics,’ accessed on 12 February 2018 at www.wgea.gov.au/sites/default/files/2016-17-gender-equality-scorecard.pdf

2. Australian Government Workplace Gender Equality Agency, “Pay gap leads to 19.3% annual super shortfall for full-time women’ accessed 13 March 2018 at www.wgea.gov.au/media-releases/pay-gap-leads-193-annual-super-shortfall-full-time-women

3. McDonald, P., 2017 ‘Homelessness: Older women couch surfing, sleeping in cars due to unaffordable housing’ ABC Online at www.abc.net.au/news/2017-08-07/older-women-become-hidden-face-of-homelessness/8782816

4. Psychology Today, 2015, ‘Being in the sandwich generation,’ accessed 15 March 2018 at

www.psychologytoday.com/blog/media-spotlight/201501/being-in-the-sandwich-generation

5. Eligibility factors apply and caps apply, please refer to website for further details.

6. The example is provided for illustrative purposes only and shouldn’t be relied on as personal, legal or taxation advice and doesn’t take the place of this type of advice either. Assumptions used in Ruby’s debt situation includes home mortgage of $400,000, interest rate (pa) of 6%, monthly repayment of approx. $2,400 per month, interest payable of $463,353, and total cost of loan of $863,353.

7. ‘Home Loan F05 Indicator Lending Rates,’ loansense.com.au, accessed on 5 March 2018 at www.loansense.com.au/historical-rates.html

8 Advice fees may apply. Refer to the Financial Services Guide (pdf) for more information.