Exchange Traded Funds growing in popularity

05 May 2021

4

min read

After a record year for inflows in 2020, Exchange Traded Funds (ETFs) have hit the ground running in 2021, with high inflows and strong performance pushing the value of ETFs listed on the Australian Securities Exchange (ASX) to a new all-time high over $100 billion this year.

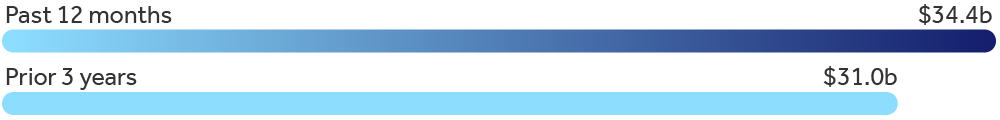

According to Lonsec Investment Solutions,1 such is the growing popularity of ETFs that fund flows into Australian-listed ETFs over the past 12 months to March 2021 have been greater than the total invested over the preceding three years.

Inflows into ETFs, along with strong performance, have seen their value (market capitalisation) increase by 80% over the past year, rising from $57 billion at the end of March 2020 to $102 billion today.

Inflows to ETFs over the past 12 months exceed those of the prior 3 years

Source: ASX Investments Product Update, Lonsec.

What are Exchange Traded Funds?

Exchange Traded Funds offer access to a wide range of Australian and international companies through a selection of pre-mixed portfolios. They are structured like a managed fund and can be traded like shares on the ASX. Learn more about ETFs here.

You can invest in ETFs using your super

Eligible QSuper members2 can access a wide range of ETFs through our Self Invest investment option, allowing them to take greater control of their funds.

And members will soon have access to a much broader range of ETFs with the current offering of 35 ETFs set to increase to 84 on 1 July 2021.

Check out our expanded range of ETFs

Check out our expanded range of ETFs

Members may consider using ETFs as a way to spread their money over a range of securities, or gain exposure to a specific sector or investment group, says QSuper Chief of Member Experience Jason Murray.

Mr Murray said Self Invest allows eligible members to trade ETFs within their QSuper account just like trading shares on the ASX. Through Member Online, members can trade continuously throughout the day, online, and in real time.

“Compared to other managed investments, ETFs offer a low-cost way to invest in a wide range of Australian and international companies,” he said.

Brokerage fees to be reduced

Lower brokerage fees will come into place from 1 July 2021. Members will also benefit from the removal of the Cash Management account fee from 1 July (was 0.40%).

Find out more

Visit our ETF webpage to learn more about ETFs and how you can use your super to invest in a wide range of Australian and international companies.

1. Lonsec Investment Solutions is a CAR No. 1236821 of Lonsec Research Pty Ltd (ABN 11 151 658 561 (Lonsec Research), holder of AFSL No. 421445). Lonsec Research provides in-depth, investigative investment research across a broad range of listed and unlisted investments. Refer to the Financial Services Guide for more information.

2. Subject to eligibility criteria, as detailed in the Investment Choice Guide. Self Invest is only available for members with an Accumulation account or a Retirement Income account.