QSuper members – insights

11 November 2021

5

min read

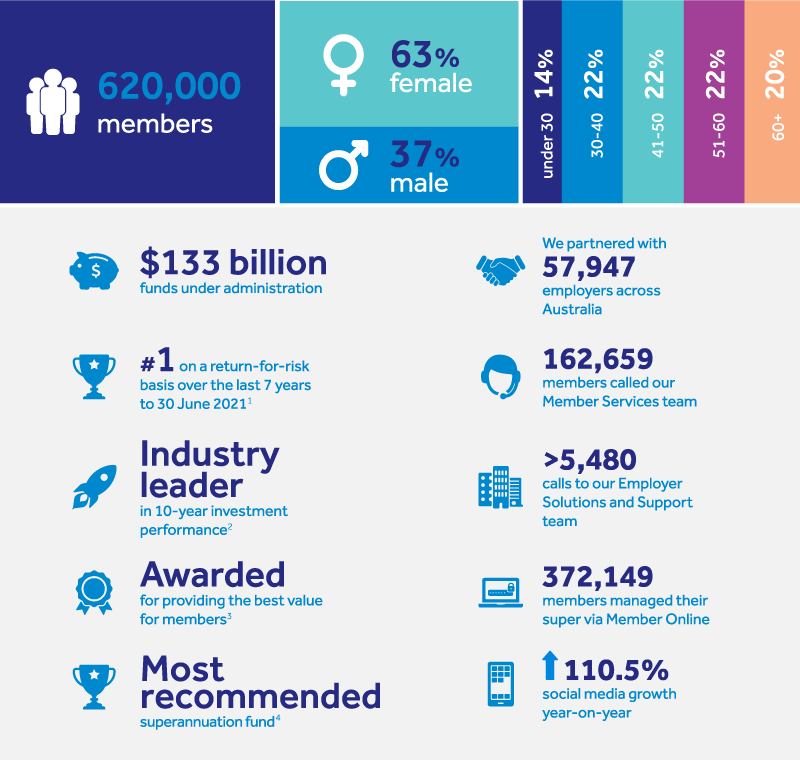

At QSuper, our members are our purpose. Everything we do is to benefit our members.

We’re one of Australia’s oldest and largest super funds and our members have come first for over 100 years. And though we’ve grown considerably since our story began in Queensland in 1913, our profit-for-members focus has remained steadfast.

Figures based on 2020/21 end of financial year

Compare QSuper

Looking to see how QSuper compares with another super fund? Use the SuperRatings comparison tool to see how we compare to other funds in the areas of:

- Investment performance and options

- Fees and charges

- Member services and more

- Insurance

The SuperRatings comparison tool is an impartial fund rating system that includes more than 200 funds.

Compare super accounts

Compare pension accounts

We’re here for you

As a profit‑for‑members superannuation fund, everything we do is for our members.

Have any questions? Don’t hesitate to contact us.

1. Lonsec, media release, lonsec.com.au/super-fund/2021/07/21/media-release-stellar-fy21-returns-as-super-funds-deliver-for-their-members/, accessed 10 August 2021.

2. Based on cumulative returns compounded annually, after fees and taxes excluding fixed administration, contribution, switching fees, and insurance premiums for the Accumulation account Balanced option. SuperRatings does not issue, sell, guarantee, or underwrite this product. Ratings, awards, or investment returns are only one factor that you should consider when deciding how to invest your super. The rating is issued by SuperRatings Pty Ltd ABN 95 100 192 283 AFSL 311880 (SuperRatings). Ratings are general advice only and have been prepared without taking account of your objectives, financial situation, or needs. Consider your personal circumstances, read the product disclosure statement, and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell, or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings uses objective criteria and receives a fee for publishing awards. Visit superratings.com.au for ratings information and to access the full report. © 2021 SuperRatings. All rights reserved.

3.

Money magazine’s 2021 & 2022 Best Value MySuper Product. Money magazine awards are solely a statement of opinion and do not represent a recommendation to purchase, hold, or sell this product, or make any other investment decisions. Ratings are subject to change. Go to moneymag.com.au for details of its ratings criteria.

4.

Mozo People’s Choice Award May 2021. Mozo commissioned IPSOS to conduct a survey to measure people’s attitudes and opinions on a range of services and their overall satisfaction with their experience towards their current superannuation provider. 2,712 were surveyed. The award winners are determined solely by the votes of customers. Mozo makes no assessment of the value or performance of products or providers and this is not a recommendation to purchase, hold, or sell this product. Ratings are subject to change. Awards are only one factor that you should consider when deciding how to invest your super. More information available at mozo.com.au/peopleschoice